Trump's Top 5 defenses in his massive NY financial fraud case, in his own words

A new transcript shows, in his own words, how Trump will fight civil fraud charges in NY next month.

"The banks made a lot of money" he said, calling claims he defrauded banks "crazy."

Trump also called his own financial filings "worthless," and said he hasn't run Trump Org in 8 years.

One Thursday this past April, former President Donald Trump sat down at a crowded conference table on the 16th floor of a lower Manhattan office building, and submitted to a day-long, court-ordered, pre-trial grilling.

New York Attorney General Letitia James has accused Trump of exaggerating his worth to banks by billions of dollars, a decade of fuzzy math she says he used to pocket $250 million in profits and saved interest.

Sitting at that conference table, defending the company founded by his father and grandmother almost 100 years ago, Trump tipped his hand on how he hopes to win an civil trial against James, who wants a Manhattan judge to bar him and his two eldest sons from ever running a business in New York State again.

The trial is scheduled to begin on October 2.

Here are Trump's top five business fraud defenses – in his own words – as revealed in a recently-unsealed deposition transcript. And here, too, is why two former lawyers for James' office say these defenses won't work.

Trump defense no: 1. It wasn't me

Throughout his deposition, Trump distanced himself from his multi-billion-dollar real-estate and golf-resort empire, the Trump Organization, telling the attorney general's lawyers that he delegated responsibility for financial filings to his senior executives and his accountants.

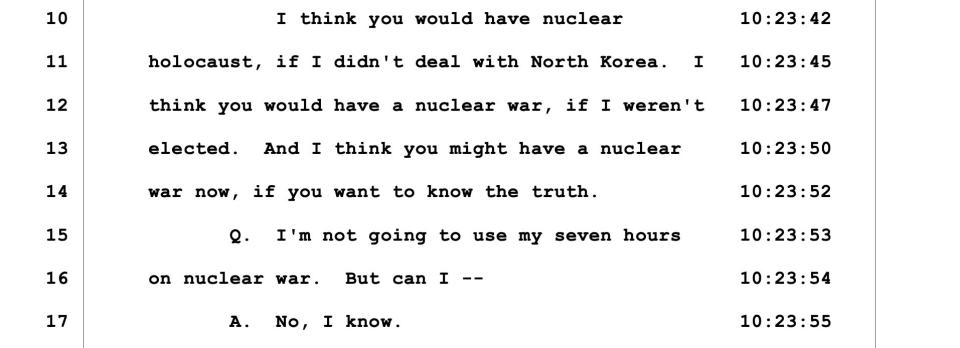

During his presidency, he was too busy saving the world from "nuclear holocaust," he said. He has played "virtually" no role, he said, since 2015, when he first ran for office.

"My son Eric is much more involved with it than I am," Trump told a room full of 14 lawyers, including the attorney general herself and four from his own defense team.

"I've been doing other things. And I guess you could say on something major, final decisions, whatever, " he added. "But I've been much less involved in it than – over the last five years, five or six years than ever before."

Asked by an attorney for James, Kevin C. Wallace, if anything would ever "bubble up" at Trump Org that he'd have to tend to in those years, the former president answered, "I can virtually not think of anything," outside of advising his executives, "they're great properties, run them."

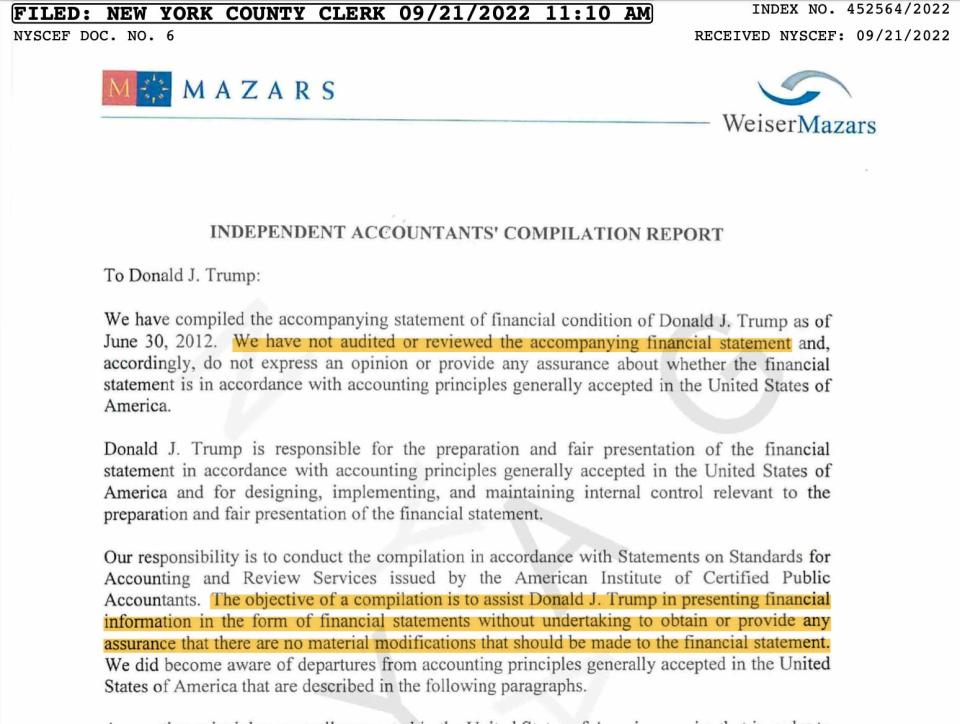

As for his allegedly fictitious financial filings, "You'd have to ask Mazars," he said, shifting responsibility for the filings' accuracy to his now-former accountants.

"They're the accounting firm. We're not," he said. "They are certified public accountants. I'm not."

Shown a 2014 financial filing that's part of the case, Trump told the AG's lawyer, Wallace, "They wrote this," of Mazars. "I didn't write it."

Trying to pass the blame won't work, two attorneys who used to work for previous New York attorneys general told Insider.

"We used to call that the SODDI defense – for Some Other Dude Did It," said attorney Kenneth Foard McCallion, a former assistant state AG and federal prosecutor.

"He controlled everything personally and the people in his inner circle have already said so in their depositions," said Tristan Snell, who was lead prosecutor on the New York attorney general's successful investigation into Trump University.

Trump defense no. 2: Everyone made money – so where's the harm?

This is Trump's "no victims, no harm, no foul" business-fraud defense.

The two lenders that fronted Trump hundreds of millions of dollars based on his allegedly wonky numbers – Deutsche Bank and Ladder Capital – made $280 million in interest thanks to those loans, Trump told those deposing him.

"You know, I'm the only one that's been sued for scamming a bank and the bank got all their money back in full," Trump complained in his testimony.

"They got a hundred percent of their money, and they took in, approximately, $280 million of profit. And you're suing them instead of going after violent criminals," he scolded the attorney general and her lawyers.

"They're very happy, by the way," he said of the two banks.

In December 2020, Deutsche Bank, Trump's largest single lender, was so rattled by the attorney general's three-year, pre-trial probe of Trump's finances that bank officials threatened to immediately call in their loans. In 2021 they moved to sever all ties with the former president.

At trial, the attorney general will certainly point to this as a sign that, once alerted to the alleged frauds, Deutsche Bank certainly reacted like they'd been victimized, Snell and McCallion said.

Then there's the $250 million Trump allegedly pocketed by lying about the size of his collateral. Much of that money should have been the banks' not Trump's, James argues.

Ultimately, the attorney general has said, the people of New York, whom she has sworn to protect, were victimized as well.

Trump defense no. 3: his math is "worthless"

At the center of the attorney general's case are a decade's worth of Trump's Statements of Financial Condition. These statements, filed annually, are roughly 20-30 pages in length and list his assets and their current worth.

Statements of Financial Condition give banks a snapshot of a prospective customers' financial health, helping them decide how much to lend, and at what interest.

After the money is lent, borrowers typically must keep sending these statements each year, for the life of the loan, to reassure the bank that their money remains in good, meaning financially-fit, hands.

In defending himself, Trump will be laser focused on the first page-and-a-half of these allegedly wildly-exaggerated statements. That's where, each year, his accountants issued a page-and-a-half long, "check this math" disclaimer that Trump calls the "worthless" clause.

In it, the accountants say they did not audit or review the financial statements.

Trump testified that he was "never very much into" what the statements said, "because I didn't think it meant anything."

He explained, "I have a clause in there that says, 'don't believe the statement, go out and do your own work. This statement is worthless. It means nothing,'" Trump testified.

His "worthless" clauses are the best in the business – the most worthless of all, he said with typical Trumpian hyperbole.

"Many lawyers have come to me and said, 'you have the greatest worthless clause I've ever seen. How can they be using this statement against you?'" he said. "I say, 'because of politics, that's why.'"

"A lot of people have a clause like that," he bragged in his deposition. "But they don't have it as strong."

Deutsche Bank "read that clause with a fine tooth comb and they accepted it," he said.

McCallion, who heads McCallion & Associates and is the author of "Profiles in Cowardice in the Trump Era," said this "sleight-of-hand argument" won't work in front of a judge.

These disclaimers are negated by other assurances in his bank filings that the attorney general will certainly remind the judge at trial, he said.

These include separate annual guarantees that promised Deutsche Bank that the statements "are true and correct in all material respects."

"His worthless clauses are themselves worthless," said Snell, founder of MainStreet.law and a frequent commentator on MSNBC.

"They do not have any effect when it comes to statutory fraud," he said of the disclaimers.

"Just because you say you're not liable doesn't mean you're not liable," he added. "You can't just have that be the end of the matter."

Trump defense no. 4: Exaggerate? My numbers were actually "way low"

Trump spent much of his deposition arguing that, if anything, his properties are worth far more than he said, not far less.

For one thing, he argued, his financial statements made no mention of the "billions and billions" of dollars in value that the Trump brand name adds to his net worth.

And for another thing, his properties are so increasingly valuable, he argued, that his valuations will "ultimately" be correct.

"Probably my most valuable asset I didn't even include on your statement, and that's the brand," he testified.

"I didn't even include that. The brand – if I wanted to create a statement that was high, I would have put the brand on," he said. "I mean I became President because of the brand, okay. I became President. I think it's the hottest brand in the world."

"I would have added maybe $10 billion or something for the brand," he added.

Shown his 2014 Statement of Financial Condition, Trump told the assistant attorney general who was questioning him, Wallace, that "properties that I have listed here for a million dollars are worth $3 million" now.

Even some of his biggest alleged whoppers will prove prophetic, he insisted – like those years when he claimed his 10,000-square-foot triplex penthouse in Trump Tower was 30,000 square feet in estimating its value at $327 million.

It's a value the AG has called "absurd," given that at that point, only one other apartment in New York City, a new, ultra-tall tower, had ever sold for even $100 million.

The penthouse may someday actually "hit those numbers, under the right circumstances," he said.

Asked about Seven Springs, his 200-acre estate in Westchester County, New York, Trump called it "the best house in the state" and defended telling banks it was worth $291 million. The AG alleges Trump based that number on plans for additional "mansions" that local zoning boards had already rejected.

"That's the kind of property that can sell for that number some time in the future," he said of the $291 million valuation.

"You know, people come up with numbers," Trump told the AG's lawyers, speaking of appraisers in general. "Sometimes they're right, sometimes they're wrong."

But his trial witnesses will set the record straight come October, he promised.

"When we testify," he said, "we're going to have numbers that are going to knock your socks off."

Snell called Trump's logic "a laughably easy defense to dismiss."

"Saying 'appraisals are subjective' and 'I get to put down anything I want,' that's not true," Snell said.

"You can be off by two percent, and probably by 20 percent," he said. "That would be what's called 'puffery.'

"But you can't be off by $2.2 million" in a given year, as James alleged in court papers Wednesday, Snell said.

Statements of Financial Condition are also supposed to reflect current appraised value, not what properties may be worth in the future," he added.

"He's asking us to treat his buildings like hot new startups" with endless financial potential, "untethered from traditional math," Snell said.

"But he can't just pull a number out of his ass and say it's true."

5. When all else fails, give 'em the ol' razzle-dazzle

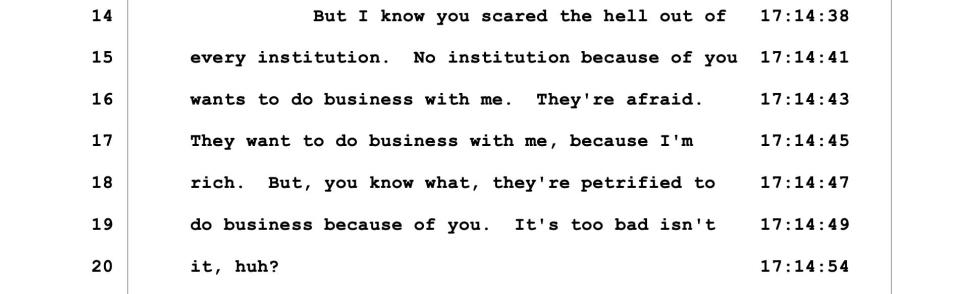

Trump spent some of his seven-hour deposition criticizing the AG's case as "a shame," and "crazy," and "unfair," and "a disgrace."

He launched into plenty of other digressions along the way, at points calling himself "a very good environmentalist," boasting of the "massive success" of his book, and extolling the marble bathrooms at his Miami golf club.

He compared himself to George Washington and asked the attorney general's lawyers if they'd ever heard of golf greats Jack Nicklaus and Tom Watson. He also bragged of his then-recent NFT sale.

"People made a lot of money. I'm happy, those are Trump people," he said of those who bought them.

At one point Trump demanded the conference room curtains be opened so everyone could admire nearby 40 Wall Street. The AG alleges Trump fraudulently doubled the worth of his stake in the skyscraper – from $220 million to $550 million – between 2012 and 2015.

"Open the curtain," Trump urged.

"No," Wallace, the lead assistant attorney general, answered flatly.

"Open the curtain, go ahead," Trump cajoled. "It's right here. I just looked out the window."

"I wouldn't," Wallace said.

Trump also called his holdings, "the Mona Lisa's of properties."

"If I ever sold them, if I ever put some of these things up for sale, I would get numbers that were staggering," he said.

"We're going to be here until midnight if your client answers every question with an eight-minute speech," Wallace complained to one of Trump's lawyers before the clock had even struck noon.

McCallion said this part of Trump's strategy is not uncommon in depositions, but won't work in court.

"The purpose in deposition is to run out the clock, and wear people down," McCallion said. "If you filibuster – or bluster – you're eating up the clock, and Trump is an expert at that."

But at trial, "you have a judge in the courtroom," telling witnesses to move it along, McCallion said.

"He's not going to razzle-dazzle anybody in that courtroom," agreed Snell.

"At trial, the judge will step in if he takes the stand and tries this," Snell added. "The judge will make him answer the question, even if he tries to go on and on about how he used marble instead of carpet in his bathrooms."

Read the original article on Business Insider