UK Economy Has Shrunk – Here's What That Actually Means

The UK economy shrunk by 0.3% in August (Photo: wenmei Zhou via Getty Images)

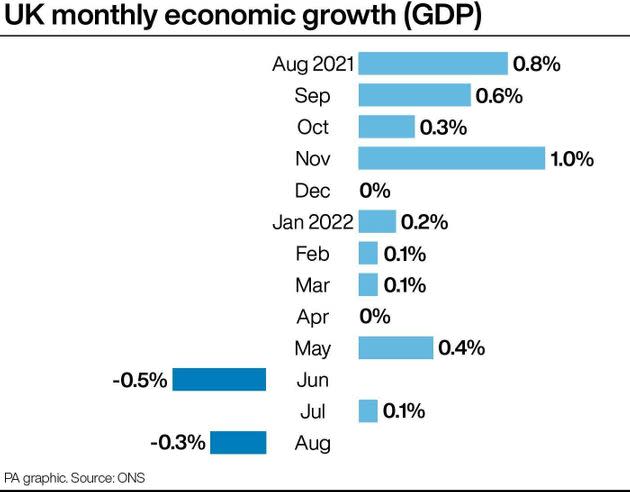

In more bad news for the government, official figures have just revealed that the UK economy shrunk by 0.3% in August.

That may sound like a marginal amount but it’s sign that a recession is becoming increasingly likely.

Here’s everything you need to know.

What happened?

The Office for National Statistics (ONS) reported on Wednesday that GDP had fallen by 0.3% in the three months leading up to August compared to the three months leading up to May.

This is, essentially, bad news. The economy is expected to grow a small amount every month, as the value of the goods and services it provides increase. This has the knock-on effect of raising Gross Domestic Product (GDP).

It becomes a recession when the economy shrinks for two consecutive quarters.These figures show that the UK is on the brink of a recession, but the economy has to shrink for another quarter before it’s official.

The value of monthly GDP is now thought to be at the same level as pre-Covid levels back in February 2020, which is quite the step backwards.

Why did this happen?

The findings are a surprise, as analysts had expected the economy only to stall in August, not to shrink.

GDP did increase by 0.1% in July after all, so this is quite a sudden drop.

ONS chief economist Grant Fitzner said the economy struggled because retailers fared “relatively poorly” in August, and sports events didn’t generate much economic value.

Less spending (due to the cost of living crisis) also reduced the amount of manufacturing, the oil and gas sector slowed.

Some industries did well, such as accounting and architecture, but these minor successes were outweighed by prices rising at their fastest rate in 40 years (due to inflation).

Less production, less manufacturing, and a fall in the services industry mean altogether there’s less money being pumped around the economy.

UK monthly economic growth (Photo: PA Graphics via PA Graphics/Press Association Images)

What does this mean?

It means a recession is much more likely.

Bank of England governor Andrew Bailey even warned in August that the UK was on the cusp of a recession which would last five quarters (15 months) – the same length of time as the 2008 financial crisis.

A recession is likely to affect the housing sector, because tenants may no longer be able to afford rent – leading landlords to sell up, or for prices to continue climbing until properties become unaffordable. Then prices get slashed, while it becomes harder to take a mortgage.

A recession also means a decline in inflation, because people stop being able to buy regular goods and services.

Despite the government’s recent tax cuts, it’s likely there will be an increase in taxes to keep essential services going while everyone is tightening their purse strings.

Low-paid workers and young people will likely be hit the hardest too, as the job market will become much harder to infiltrate.

What happens next?

September is expected to see an additional decline, especially after the extra bank holiday for the Queen’s funeral and the reduction in service hours during national mourning.

Kwasi Kwarteng’s September mini-budget will likely be blamed too, for sparking disruption in the markets and increasing mortgage rates. It has also prompted the pound to fall in value – and, weeks later, it has still not recovered.

The International Monetary Fund (IMF) has also warned that 2023 would “feel like a recession” due to rising costs and the Ukraine war. It has also downsized its forecast for UK growth. Now, it expects the UK to grow by only 0.3% next year, compared to previous predictions of 0.5%.

It’s not just the UK though – European markets have declined, as will Asian stocks. IMF warned on Tuesday that the “worst is yet to come”, as the war in Ukraine affects prices around the world.

How has Westminster responded?

Business secretary Jacob Rees-Mogg told the BBC’s Today programme that monthly figures are volatile and “very often subject to revision”.

But he said the decline in economic growth in August “showed the need for the mini-budget in September”, even though it caused the pound to plummet in value.

He also blamed the trouble on the markets due to the difference between the US and the UK markets, claiming: “It’s much more to do with interest rates than it is to do with a minor part of fiscal policy.”

Kwarteng also commented on the new stats, claiming: “Countries around the world are facing challenges right now, particularly as a result of high energy prices driven by Putin’s barbaric action in Ukraine.

“That is why this government acted quickly to put in place a comprehensive plan to protect families and businesses from soaring energy bills this winter.

“Our growth plan will address the challenges that we face with ambitious supply-side reforms and tax cuts, which will grow our economy, create more well-paid skilled jobs and in turn raise living standards for everyone.”

But, Labour’s shadow chancellor Rachel Reeves said the news demonstrates “the economy is still in a dire state because of this Tory government”, and called for Downing Street to reverse its “disastrous mini-budget”.

This article originally appeared on HuffPost UK and has been updated.