Victoria mortgage broker misses court deadline to produce documents but 'making efforts,' lawyer says

The Victoria mortgage broker who owes investors $226 million has missed a B.C. Supreme Court ordered deadline to produce a sworn list of assets and key financial documents, according to his Vancouver lawyer.

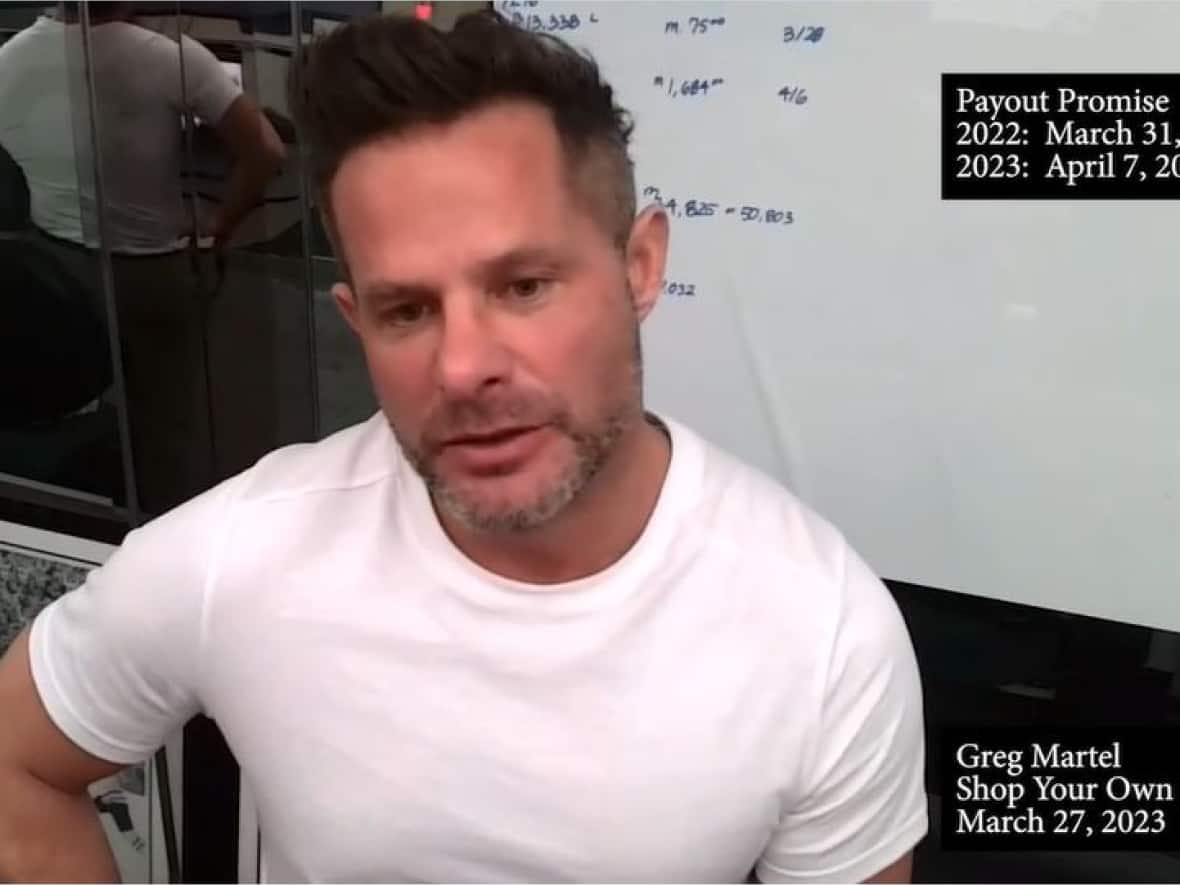

Ritchie Clark said Greg Martel, the man at the centre of the financial scandal, claims to be having trouble with passwords needed to access some of the information demanded of him by Friday, May 26.

At the last court hearing into the case, Justice Shelley Fitzpatrick said Martel faces serious legal jeopardy for not co-operating with the court and investigators from receiver PricewaterhouseCoopers (PwC) assigned to track the missing millions.

Clark said Martel has been on conference calls with PwC this week and has plans to return to the country from an undisclosed location.

"He is certainly making efforts to comply with orders," said Clark.

CBC reached out to PwC but did not hear back by deadline. Numerous requests have been made to Martel for an interview with no response.

Trouble began brewing earlier this year when investors started complaining Martel's company, Shop Your Own Mortgage (SYOM), was getting slower and slower in paying out the money they were owed. Then the payments stopped altogether.

Over a dozen lawsuits were filed against Martel and SYOM, and earlier this month, they were placed into court-appointed receivership on an application by an Alberta-numbered company claiming it is owed $17.6 million.

In an online video, Martel said SYOM has 2,000 investors. According to a list of unsecured creditors, investors are owed $226,368,704.

Investigators have not been able to track where the millions that flowed into the SYOM bank account have been moved to, nor find documents supporting the existence of the high-interest bridge loan investments Martel was selling.

The bleak scenario has led some to speculate he was running a Ponzi scheme.

Trevor Patrick of Victoria doubts he'll see any of the $440,000 owed to him by Martel. To make matters worse, without at least a portion of it, Patrick stands to lose even more on a condo he legally committed to buying.

"I've been trying to get my money out [of SYOM] since January, and unfortunately, everything's kind of frozen. We don't have any answers, whether it's a Ponzi scheme, whether there was theft, if the money is lost, or what... but I could be looking at a potential lawsuit from the developer if I can't close on the condo," he said.

Patrick said he texted Martel on Monday, asking him to come clean.

"My message was read, but no reply. I just said if he values his name... just to be honest."

"The not knowing's the hard thing," said Patrick. "This is hurting a lot of people."

The next hearing date in B.C. Supreme Court in Vancouver is June 9.