Abu Dhabi Fund Led Outflows From Turbulent Colombian Bond Market

(Bloomberg) -- Abu Dhabi’s $800 billion sovereign wealth fund led sales of Colombia’s local government bonds during a turbulent October that saw the nation’s debt and currency plunge.

Most Read from Bloomberg

‘It’s All Gone’: FTX Bankruptcy Has Retail Traders Bracing for Losses

China Plans Property Rescue as Xi Surprises With Policy Shifts

Democrats Defy History, Keep Senate Control in Victory for Biden

Bankrupt FTX Hit by Mysterious Outflow of About $662 Million

Canadian pension fund manager Caisse de depot et placement du Quebec also ditched some of its holdings, as the Andean nation saw net outflows from foreign fund managers for the first time in 11 months.

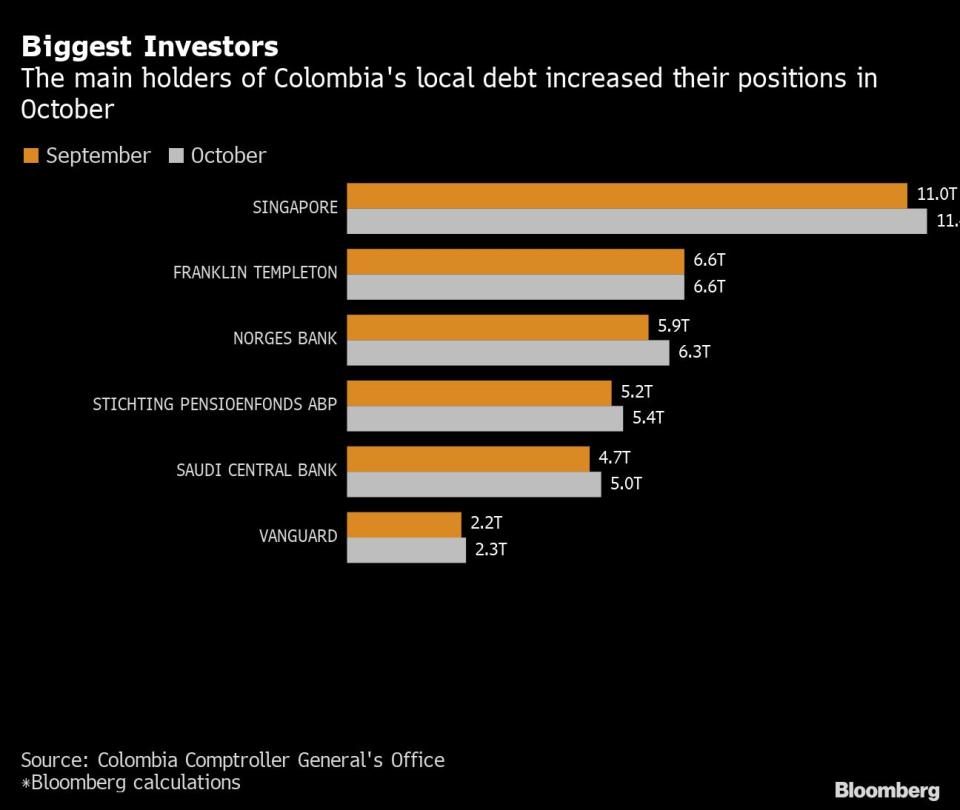

At the same time, Singapore and Norway, the biggest holders of the bonds, both added to their positions over the period.

The Abu Dhabi Investment Authority and Caisse de depot et placement du Quebec between them sold a combined 1.38 trillion pesos ($288 million) of the securities in October, according to data from the Comptroller General’s office. Foreign funds sold a net 1.51 trillion pesos of the bonds, which are known as TES, during the month.

Some investors have been on edge since the election of Gustavo Petro in June, and have been worried by his pledges to phase out the fossil fuel industries which account for about half of Colombia’s exports. His criticisms of the central bank, and a Tweet in which he suggested that capital controls would be preferable to tighter monetary policy, also made some money managers nervous.

Read more: Colombia Policy U-Turns Pile Up Under Leftist Leader

Even so, in the year through October, foreign investors have been net buyers of 21.5 trillion pesos of TES, overtaking local pension funds as the largest holders overall. Foreign funds now hold about 26.6% of the total.

Top Holders

Singapore, whose government and central bank are between them the largest holders of TES with about 11 trillion pesos, added about 49 billion pesos to their holdings. Norges Bank, which manages Norway’s sovereign wealth fund, was the biggest buyer of TES during the month, accumulating an additional 425 billion pesos. Netherlands fund manager Stichting Pensioenfonds ABP also increased its TES holdings by 212 billion pesos.

Funds managed by Ashmore Group, Citigroup Inc, Legg Mason Inc., and BlackRock Inc were net sellers, while Vanguard Group Inc was a net buyer.

The turbulence in Colombian markets in recent weeks sent the yield on TES maturing in 2031 above 15% in October, from less than 8% a year ago. The securities have since recovered somewhat, and currently yield about 13.5%.

Most Read from Bloomberg Businessweek

Americans Have $5 Trillion in Cash, Thanks to Federal Stimulus

One of Gaming’s Most Hated Execs Is Jumping Into the Metaverse

A Narrow GOP Majority Is Kevin McCarthy’s Dream/Nightmare Come True

Meta Investors Are in No Mood for Zuckerberg’s Metaverse Moonshot

©2022 Bloomberg L.P.