New Brunswick apartment buildings attracting high prices and national buyers

The recent buying and selling of apartment buildings in New Brunswick, many at record prices and involving out of province corporate buyers, requires government to ensure tenants are treated fairly and neighbourhoods remain affordable to everyone, according to a pair of academics who study changing Canadian social structures.

"It's important to make sure that we sustain the things that we love about the Maritimes while also taking advantage of the new energy and growth that's happening," said Western University sociologist Howard Ramos, who has studied the changing face of Atlantic Canadian cities

"It's important for us to begin to be creative in our policy."

A major sale of 20 apartment buildings in Saint John last week and news this week of stunning rent hikes at a recently purchased rental property in Moncton have elevated concerns about rental markets in the province that for years have been the source of little controversy.

According to Statistics Canada, average apartment rent in New Brunswick has increased just 11 per cent over the last decade, well below the rate of inflation.

But with the market for rental properties heating up, and national investors helping to bid up prices, there are worries much larger increases may be on the horizon.

By mid–September in Moncton, property records show four dozen apartment buildings holding more than 500 rental units had sold this year for a combined $47.5 million. That is $10 million above what the buildings were assessed to be worth by Service New Brunswick before being sold, a sign of how demand for rental properties has been growing

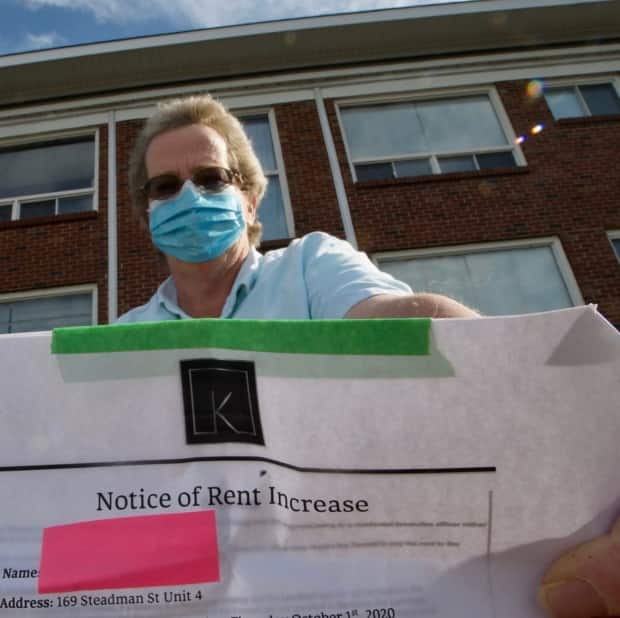

William Morissette's 12 unit building on Steadman Street in Moncton was one of those sold to out of province investors in late August. Montreal based Bon Accord Real Estate Inc. paid $775,100 for the building, 51 per cent more than its assessed value.

Five weeks after the sale closed Morissette was given three months notice of a 62 per cent rent increase and the end of free heat in his unit, coming Jan. 1.

"In all my years, it's a first. I never saw an increase at that, I never thought it was even legal, but apparently they can do it," Morissette told CBC News.

Many of the bigger sales in Moncton this year have involved out-of-province money. In March, a Halifax numbered company paid $10.3 million for 89 units in two buildings on the Lewisville Road, $2.4 million over their assessed value.

In early June, a British Columbia numbered company bought a 30 unit building on Salisbury Road for $3.6 million, well above the $1.96 million it was valued at by the province.

And in late June an Ontario numbered company bought two older buildings on High Street for $1.55 million, 50 per cent over their assessed values.

Ramos says those investments are positive for Moncton, but they would be better if there were mechanisms in place to ensure existing low income renters, like William Morissette, didn't automatically get pushed aside by new owners looking for higher income residents.

"One of the positives of gentrification are reviving neighbourhoods, bringing new energy, having new businesses, having new people. And these are all good things for a neighbourhood," said Ramos

"The downside is if it ups the cost of rent or housing for people who are longtime residents or if it pushes them out of the neighbourhood."

Ramos believes rent subsidies, like those used in Europe, or some form of enhanced basic income like many people received from Ottawa for pandemic relief are ways to let low income people remain in neighbourhoods even as those areas prosper.

"These are things that we haven't really talked about for the last 30 or 40 years in Canada as we've gravitated towards the market based solutions for housing," said Ramos.

In Saint John, the largest purchase of rental properties was by a local company, Historica Developments, but it too was at prices above current assessments.

According to records, the company paid $6.8 million for 20 buildings and some adjacent parking lots, $1.3 million above government valuations of the properties. But apart from that one major transaction, the city has also seen out-of-province money arrive to buy up apartment buildings.

The same British Columbia numbered company that bought the 30 unit building on Salisbury Road in Moncton in June paid $1.67 million in July for a 15 unit building on Technology Drive in Saint John.

Matthew Hayes, an associate professor in the department of sociology at St. Thomas University, believes a combination of the pandemic, low real estate prices in New Brunswick and a lack of protections for renters has made the province attractive to outside real estate investors.

"A number of the local rental stock is dated and assessed at a lower value. So they're seeing a bargain and they're going to come in and swoop it up," said Hayes

"With all of the kind of liquidity that was created in March, we now have a lot of investors basically with excess capital looking for a place to park it. And it's been housing. Because of the crisis, millennials and retirees are much more likely to rent in the future."

New Brunswick has long had protections for homeowners against large and sudden increases in property taxes, but there are no similar protections for renters facing price shocks and Hayes believes those need to be looked at, given the changing nature of who is owning apartment buildings in the province.

"We need to recognize that the landlords now that are becoming really important in Canada are shareholders who are not in New Brunswick, who may not even be in Canada. And we need to protect people who live here from some excesses that they might want to impose," said Hayes.