Colombia Plans to Raise Budget Deficit Target as Oil Slumps

(Bloomberg) -- Colombia plans to raise its deficit target for 2023 as the price of oil, its main export, trends lower, according to a senior Finance Ministry official.

Most Read from Bloomberg

China Takes the Yuan Global in Bid to Repel a Weaponized Dollar

TD, First Horizon End $13 Billion Merger as Regulators Stall

PacWest Is Weighing Strategic Options, Including Possible Sale

Bank Drama Rages On; Apple Climbs in Late Trading: Markets Wrap

The Latin American country is mulling changing its projected fiscal deficit to as high as 4.2% of gross domestic product from the current target of 3.8%, public credit director José Roberto Acosta said in an interview Wednesday. The revised deficit would still meet the country’s fiscal rule, which seeks to control government borrowing and ultimately bring down debt levels.

“The deficit will likely be revised upwards but always within compliance with the fiscal rule,” Acosta said in an interview in his office in Bogota.

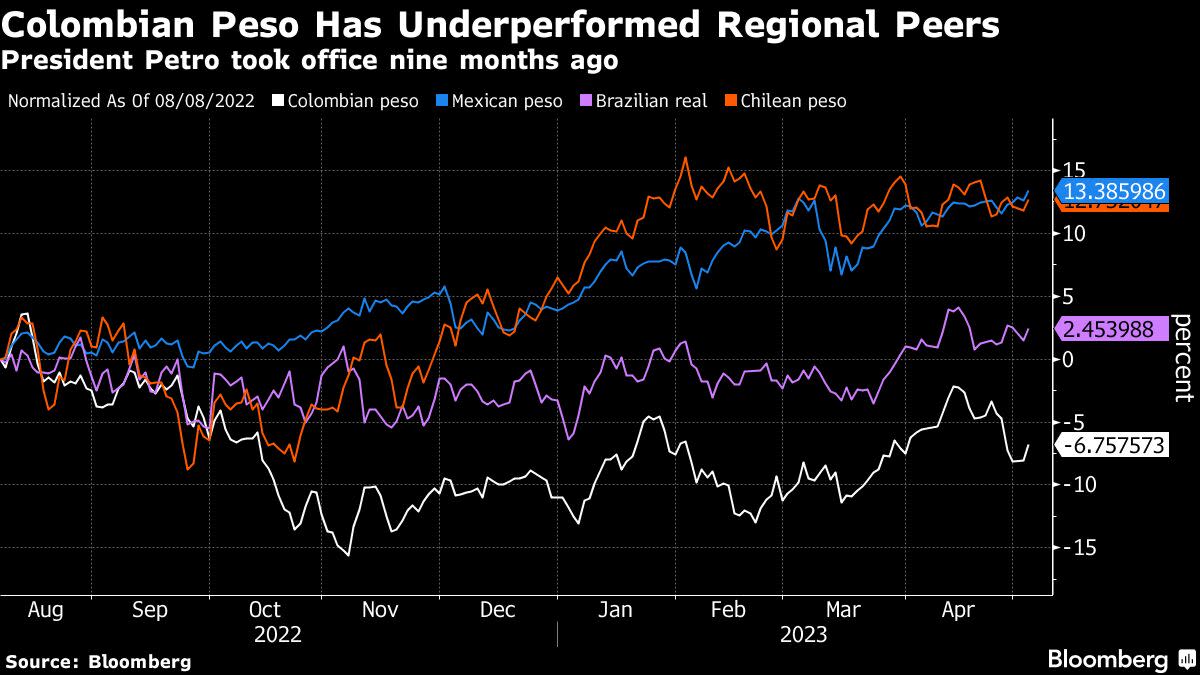

President Gustavo Petro, who has repeatedly spooked markets with proposed reforms, caused a sell off last week with a cabinet shakeup, which included the ouster of his market-friendly finance minister. The peso weakened 3.9% against the US dollar last week, the most among more than 140 currencies tracked by Bloomberg, trimming year-to-date gains to about 4%.

The currency rose 1.5% Wednesday, climbing along with emerging-market assets after the US Federal Reserve signaled a pause in interest rate increases.

Market ‘in charge’

Part of the reason to boost the deficit goal is a downturn in oil. In its fiscal plan, the government had estimated average Brent crude prices of $94 per barrel in 2023, far above the $72 per barrel the commodity traded at on Wednesday.

Ratings firms already know about the plan to lift the target, according to Acosta, who said it’s unlikely the country recovers its investment grade in the short term. He hopes efforts to comply with debt and fiscal commitments will help improve Colombia’s outlook to positive — the country’s sovereign debt was cut to junk by Standard & Poor’s and Fitch Ratings in 2021. Both have a stable outlook.

Finance Minister Ricardo Bonilla, who took office Monday, is committed to the fiscal rule, Acosta said, adding that the government will speed up the pace at which it wants to close the deficit of a fuel price stabilization fund. The government will begin in June a series of increases in prices of diesel, which is mainly used to transport food and staples.

“It is ethically unacceptable that the oil boom or surpluses are going to fill fuel tanks and not the bellies of children and the elderly,” he said.

Net flows from foreign investors into the local bond market jumped to 1.3 trillion pesos in April, or about $280 million, after remaining relatively stable in March, showing that Colombia’s risk remains appealing for international investors, Acosta said.

“The voice of the market is a guide for this government,” he said. “The market is in charge.”

Bond plans

While the country’s 2023 financing needs are already covered after it tapped markets in January, Colombia is watching for opportunities to pre-finance 2024 budget needs, according to Acosta. A potential window for issuance of a global bond could emerge in the second half of the year, he said, adding that the Finance Ministry could also consider selling more local debt to pre-finance 2024 commitments.

In March next year, Colombia will begin quarterly payments of about $650 million of the International Monetary Fund’s flexible credit line the nation drew during the Covid-19 pandemic.

(Updates with more details from the interview starting in fifth paragraph)

Most Read from Bloomberg Businessweek

Twitter’s Unpaid Bills Threaten to Be an Even Bigger Problem for Elon Musk

How a Dishwasher Engineer Challenged Elon Musk’s Grip on Commercial Space

The Company Behind Ben Shapiro Is Trying to Build a Right-Wing Magic Kingdom

Cadillac’s Lyriq EV Might Be a Winner If GM Can Build Enough of Them

©2023 Bloomberg L.P.