Alberta may be racking up budget surpluses but the province's fiscal hangover will linger on

Alberta might be racking up budget surpluses due to burgeoning oil prices but the province's fiscal hangover from the past 20 years will last into the next century.

As of March 31, the provincial debt stood at $79.7 billion. That's after a massive $13.4 billion in debt payments were made in 2022-23.

Finance minister Travis Toews has mused about paying off the debt. But that won't actually happen no matter how many multi-billion dollar surpluses the province might post in the coming years.

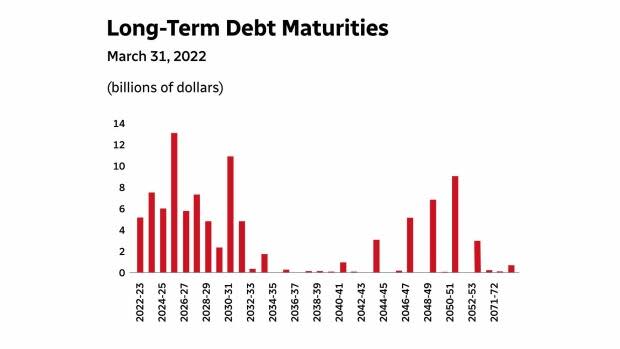

That's because the province has debt payments coming due in various years between now and the year 2120.

That's right. On June 1, 2120 Alberta has a $700-million payment to make.

A professor in the department of economics at the University of Calgary, Trevor Tombe, said paying off debt early can come with huge penalty charges.

So it really isn't done.

However, Tombe said what governments with spare cash typically do is set aside money in a special account that can be tapped when the debt comes due.

It's happened before in Alberta.

Not really debt free

It's become part of Alberta political folklore that the government of then premier Ralph Klein in 2004 paid off the $22 billion in debt accumulated by the Lougheed, Getty and Klein governments.

It was actually a bit of theatre.

"So when Ralph Klein famously held that paid-in-full sign over his head, it wasn't literally true," said Tombe.

"There still existed outstanding government bonds but the government had set aside just the right amount of cash in a special account that would be used to repay the bonds when they did come due."

Alberta wasn't debt free even when the final payments were made in 2014. That's because by then, subsequent PC Party governments had started to rack up new debts.

The Alison Redford government took out debt that is structured out to the middle of this century.

Since then, subsequent governments from premiers Hancock to Prentice to Notley and Kenney have added to the red ink.

It was the Kenney government in the early days of the pandemic in 2020 that took on that 100-year bond.

Tombe said that was a tough time to take on new debt and the government found merit in locking into a long-term debt like that because interest rates were at an "incredibly low level."

Quiet on election trail

The debt hasn't been much of a talking point in this month's provincial election so far.

Rebecca Schulz, who is running for the UCP in Calgary Shaw, said the government's new fiscal framework requires balanced budgets.

It's calling for future surpluses to be used to build up the new Alberta Fund, which could then direct cash to the Heritage Fund and use cash for specific capital projects.

She said the idea is that the province can build up its cash reserves. That way, it can pay off the debt when it comes due but also earn interest from those funds, creating new cash which can be applied to government priorities.

"We do have an opportunity here to strengthen our economic future and avoid some of the mistakes of the past that led to the situation we're in today when it comes to debt burden," said Schulz.

But the government won't go as far as incurring penalty charges for early repayments because that money is needed elsewhere. Instead the focus is on making payments on time.

"We're making sure that we are paying down debt as it matures," she said.

NDP wants to save, too

The NDP has a similar plan.

Shannon Phillips, who is running in Lethbridge West, said the party asked the former chief economist of ATB Financial to come up with a plan for dealing with future budget surpluses.

Todd Hirsch's report was accepted in full by the party.

He suggested an NDP government should make debt repayment the default option for any surplus cash.

Phillips is critical of past governments for failing to invest in the Heritage Fund.

"What we have to do is ensure that in good times, we are using as much of that money to generate future cash flow as we can, either by retiring debt if that makes the most sense economically or by saving it in the Heritage Fund so that we are generating more proceeds to pay for our programs," she said.

For the NDP, that means the investment earnings from that cash could help pay for things like healthcare or education.

Phillips said it doesn't make much sense to have a tidy balance sheet if Albertans can't find a doctor or they can't afford things like car insurance or their electricity bills.

Generating savings key

For his part, Tombe has crunched some numbers on the debt.

He believes that if oil prices average $80 US this decade, Alberta could theoretically set aside enough money by 2030 to cover all of its future debt payments over the next century.

"Whether Alberta can depends entirely on oil prices. And of course, isn't that the Alberta story? Our fortunes are tied to this fundamentally unpredictable commodity that is incredibly volatile."

He said Alberta's debt is relatively small compared to other provinces in Canada and that it is able to service its debt.

In that respect, Tombed noted Alberta is very far from the financial situation it faced in the 1930s when the provincial government defaulted on its debt.

What matters to you this election?

CBC Edmonton and CBC Calgary are out on the streets this campaign, asking as many people as possible what they want the candidates to be talking about.

WATCH | Here are views from a cattle auction in Strathmore.

How about you? Weigh in at cbc.ca/whatmatters or watch for us in the community.