We Explain the Debt Ceiling — and How Defaulting Would Impact You — in Less Than 5 Minutes

Experts warn that we’re days away from unprecedented “economic catastrophe” if politicians can’t reach an agreement on raising the debt ceiling — here’s the SparkNotes version of what’s happening in Washington right now

What is the debt ceiling, and why is the U.S. treasury secretary warning we could be headed for "economic catastrophe"?

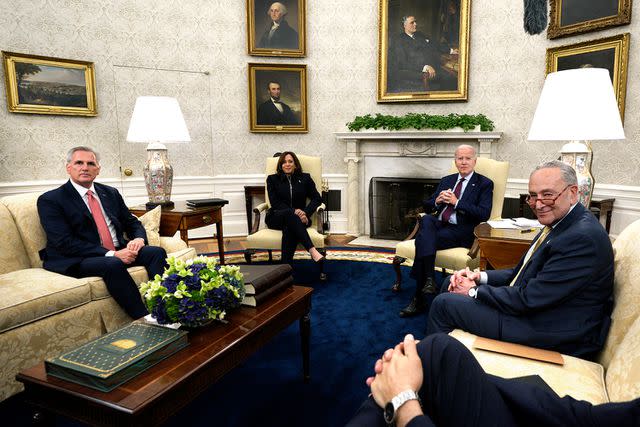

President Joe Biden has been meeting with Republican House Speaker Kevin McCarthy and other congressional leaders to negotiate a plan for raising the debt ceiling, with the goal that Democrats and Republicans will come to an agreement that prevents a recession and saves countless jobs nationwide.

Here's a beginner's guide to the debt ceiling drama happening in Washington right now, and how it could affect you and the state of American politics.

What is the debt ceiling and what does 'defaulting' mean?

The debt ceiling is the total amount of money that the federal government is authorized to borrow to meet its existing legal obligations (which include things like Social Security and Medicare benefits, military salaries and tax refunds).

Defaulting on that limit would mean the federal government runs out of money and can no longer pay out those debts. So anyone receiving any sort of payment from the federal government — Social Security payments, military and veterans benefits, food stamp payments, etc. — would not get those payments.

With a majority vote in both the House and Senate, Congress can choose to raise the debt ceiling and avoid defaulting — but it's not a decision taken lightly, particularly among Republicans who ran on platforms of cutting costs to lower the national debt.

How would an economic default impact Americans?

The U.S. has never defaulted on its debt before, so the impact of what would happen can't be overstated. In short: It would be a catastrophe. "There will be no acceptable outcomes if the debt ceiling isn't raised, regardless of what decisions we take," Treasury Secretary Janet Yellen said in a recent interview with NBC.

If America were to default on its debt, millions of Americans would go unpaid — and anything the government spends money on, from social programs to the military to veteran health programs, would be unfunded. And then there's the global financial upheaval that would take place in the wake of the most powerful economy effectively collapsing, the likes of which would no doubt rival even the 2008 global recession.

In a letter sent to Speaker McCarthy, Yellen wrote: "If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests."

While the U.S. has never defaulted before, economists have offered up their predictions of what a default would mean, often presenting a scenario that would reverberate through the global economy for decades to come.

"A default would fundamentally hinder the Federal government from serving the American people," a group of economists wrote in a 2021 article published on the White House's website. "Payments from the Federal government that families rely on to make ends meet would be endangered. The basic functions of the Federal government — including maintaining national defense, national parks, and countless others — would be at risk. The public health system, which has enabled this country to react to a global pandemic, would be unable to adequately function."

Students who receive financial aid or benefit from school lunch programs would also be impacted, as would the 9 million veterans who receive physical, mental health and other types of care from the government.

"In short, the United States has never intentionally defaulted on its obligations for one reason above all others: the self-inflicted economic ruin of doing so would be catastrophic," the economists wrote.

How long do we have until the U.S. defaults on its debts?

The amount of revenue the federal government collects and spends is variable, making it difficult to nail down an exact date that a default will take place. But in her letter sent to Speaker McCarthy, Yellen estimated that the U.S. will stop being able to pay its bills beginning as early as June 1.

"With additional information now available, I am writing to note that we still estimate that Treasury will likely no longer be able to satisfy all of the government's obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1," Yellen wrote.

Yellen added that "waiting until the last minute" to increase the debt could also cause damage, urging lawmakers to be proactive and negotiate with time to spare.

"We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States," she wrote.

Why are politicians struggling to find a solution?

Both Republicans and Democrats want to avoid a default, but they'd also like to use debt ceiling negotiations as a bargaining chip of sorts. In short, neither side wants to concede much and risk criticism from members of their party.

Republicans, led in negotiations by Speaker McCarthy — who oversees the GOP-controlled House of Representatives — have said they will reject any short-term increase of the debt ceiling without negotiating government spending cuts to help turn the debt cycle around.

The trick, however, is that those cuts would likely scale back government programs that Democrats have fought hard for, which puts President Biden — who doesn't want to disappoint his base or destroy his party's platform — in an uncomfortable position during negotiations, especially ahead of a tense election year.

Speaking to CNN, one source said Republicans submitted a budget proposal that includes immigration provisions as well as changes to the work requirements for food stamps — two things Biden likely won't accept.

Biden himself seemed to signal that negotiations had been stalling in a press conference on Sunday, in which he called the Republican proposal "simply, quite frankly, unacceptable."

"It's time for Republicans to accept that there's no bipartisan deal to be made solely, solely on their partisan terms," Biden added, CNN reports.

Never miss a story — sign up for PEOPLE's free daily newsletter to stay up-to-date on the best of what PEOPLE has to offer.

McCarthy has pushed back, telling reporters Biden was "changing positions" on his own proposal and accusing him of being influenced by the most left-wing members of the party.

"The president keeps changing positions every time Bernie Sanders has a press conference. He gets reactive and he shifts," McCarthy told reporters Sunday, per CNN.

By Monday, McCarthy adopted a more optimistic tone that a deal could be made in time to prevent a default. Monday's meeting came and went without a deal, and Tuesday began with McCarthy saying there was more work to be done, asking his Republican colleagues to be patient with him.

If a deal is made, McCarthy will need to get House Republicans to support his deal, call a vote on raising the debt ceiling, and send the legislation to the Democrat-controlled Senate so that it can get passed and signed into law by Biden before the fast-approaching deadline.

For more People news, make sure to sign up for our newsletter!

Read the original article on People.