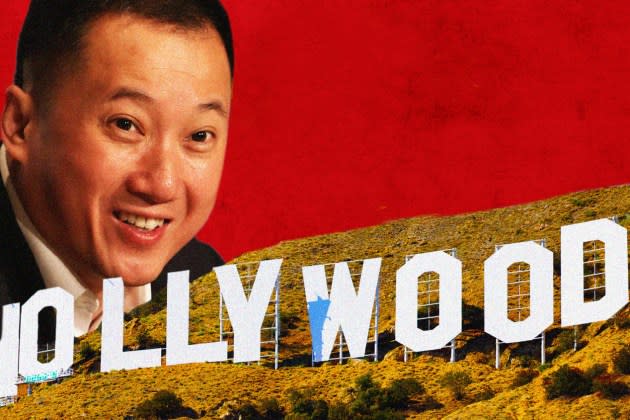

Investigation: How An Extravagant Chinese Financier Charmed Hollywood’s Elite Before Vanishing, Owing People Millions

Kenneth Huang was known for his particular taste in wine. Whether in his favorite corner of Cut, the Michelin-starred steakhouse at the Beverly Wilshire, or in the Peninsula Shanghai, Huang would summon a bottle of Opus One to the table. He would tell guests that he had a private reserve of the Napa Valley vineyard’s 2011 vintage, which retails for up to $2,000 a case. Someone who regularly dined with the financier says she drank so much Opus One that she got sick of the bourgeois Bordeaux.

If the wine was Huang’s signature, it was a footnote in a picture rendered to create a specific impression. An outsider in a town familiar with cautionary tales about Chinese riches, Huang was performative about his wealth in a way that put Hollywood power players at ease. He would allow them to think: if this man puts studio executives on private jets to Beijing and turns up to coffee meetings in a Lamborghini Aventador, he is capable of funding independent movies. And he was. Impatiently so.

More from Deadline

James Gunn Shuts Down Conspiracy Theory About Henry Cavill's DCEU Exit

James Gunn Says Zack Snyder Has Been "Incredibly Supportive" During DCU Transition

'Superman': Neva Howell To Play Ma Kent In James Gunn's DC Movie

After acting as Paramount’s conduit to the Middle Kingdom, Huang set up shop in the shape of The H Collective (THC) in June 2017. He collected a team of experienced and trusted Hollywood executives who got to work making movies. Within less than six months, the outfit was in production on Aaron Paul thriller The Parts You Lose alongside Breaking Bad producer Mark Johnson. During a breathless three-year period, THC linked with James Gunn on superhero horror Brightburn, attempted to reboot Vin Diesel’s xXx franchise, and dried ink on a distribution deal with Sony Pictures. People in Huang’s orbit were unsure where the money was flowing from, but few were prepared to pollute the well with questions.

THC was a legitimate operation and Huang appeared to be the real deal. Until he was not. As quickly as THC blossomed into life, the company rotted from its sapling roots and Huang vanished from view. A six-month Deadline investigation has revealed that he left behind a litany of lawsuits; colleagues and investors owed tens of millions of dollars; a messy and unresolved dispute over the xXx franchise; mortgage defaults on a palatial Bel Air house; more than $160,000 in unpaid office rent; and scripts from writers, including John Wick scribe Derek Kolstad, with no clean chain of title.

The biggest blow to Huang’s reputation was delivered by his onetime friend Hiroshi “Mickey” Mikitani, the Japanese Jeff Bezos. Deadline can reveal that Mikitani’s tech and media giant Rakuten successfully sued THC and Huang for $52M after claiming it was the victim of a “Ponzi scheme” that served to fund the Chinese financier’s lavish taste in supercars and cigars.

Deadline has spoken with more than a dozen people once close to Huang, most of whom wished to remain anonymous amid fears he could retaliate. Some did not wish to speak at all. “I’d rather not jump into the ring with a crazy billionaire,” jokes one person. Many have come to consider Huang as the archetypal charismatic conman, but the reality is complicated and some continue to hold him in their affections.

Huang has not responded to repeated requests for comment. Several sources say he was diagnosed with cancer during the pandemic and has been receiving treatment in Asia. Kent Huang — his brother, loyal ally, and close business associate for years — was unable to answer specific questions about the allegations against Huang. Kent says he was not privy to his brother’s financial arrangements, but acknowledges that people are owed money. He has not heard from Huang in more than six months. The THC brand limps on, meanwhile, with Kent at the helm.

Kenneth Huang’s trail of chaos in Hollywood is the focus of this story, but zoom out and you build a picture of a character who has echoes of Leonardo DiCaprio’s portrayal of Frank Abagnale Jr. in Catch Me If You Can. Huang tried on guises like Abagnale tried on Pan Am pilot hats. He had some success stories, but a series of ambitious investment deals he captained crashed and burned. For his Hollywood friends, the warning signs were hiding in plain sight.

Huang, now 61, was born in Guangzhou to a successful family with strong business and government ties. His parents moved to the U.S. in 1999, but Huang (whose Chinese name is Huang Jianhua) went back and forth between America and his homeland cultivating business relationships.

Known to his allies as Kenny, he got one of his first significant introductions to Hollywood when he took his seat at the 2004 Super Bowl. As Janet Jackson’s modesty was exposed by Justin Timberlake and the New England Patriots triumphed, Huang was doing what he did best: forming enduring connections with influential strangers.

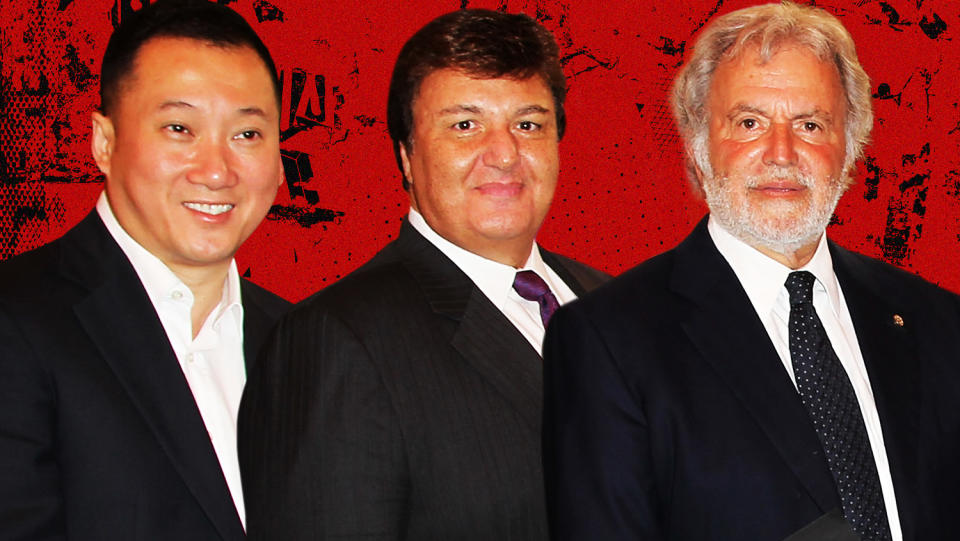

Having boasted about being the first Chinese national to work on Wall Street, he had launched marketing company Sportscorp China, fixing deals to help baseball teams, including the Yankees, expand their reach in China. His business partner was Marc Ganis, a sports industry consultant who styles himself as an adviser to NFL commissioner Roger Goodell. Ganis sat Huang next to Sid Ganis, a Hollywood executive of no relation who was known for launching Top Gun and would later become president of the Academy of Motion Picture Arts and Sciences.

Sid Ganis was charmed by Huang and opened his professional network to his new Chinese friend at a time when Hollywood was looking to the East for new money. Seven years after their Super Bowl encounter, they were in business together with Jiaflix, a U.S.-based company that sought to build bridges in China for American studios. It facilitated deals to bring Lionsgate, MGM and Paramount content to Chinese audiences on government-owned streaming service M1905.com. Sid Ganis tells Deadline that he “very much likes and appreciates” Huang but has not spoken to him in a long time. Marc declined to comment.

A studio executive who knows Huang says the conditions were right for a man of his skills. Hollywood had fixed its gaze on the Red Dragon, hoping it could breathe fire into box office sales, and Huang was a middleman for investment. “It was a moment when Chinese money and entertainment were fusing themselves together,” this person says. “It was the perfect time for someone like Kenny to come in.”

Huang was not your average fixer. Weary Hollywood executives will tell you that it takes false starts and hard yards to make progress in China, but Huang dazzled associates with extraordinary access in his homeland. One person says that at the height of his powers, Huang was China’s answer to Ari Emanuel, affording him unique influence at the nexus of the nation’s entertainment business.

It is unclear how close he was to China’s communist regime, but his connections suggested that he operated with the blessing of authoritarian leaders. Sometimes the subtle things gave this away: one of Huang’s friends recalls being met by a car on the tarmac of Beijing airport and clearing security through a VIP border control room.

Paramount saw Kenny as the key to unlocking China and Huang formed a productive working bond with Rob Moore, the former vice chairman of Paramount Pictures. Moore declined to comment. Huang brokered meetings with China’s minister of culture, superstar actress Fan Bingbing, and Jack Ma, the billionaire Alibaba founder who eventually invested in Tom Cruise’s Mission: Impossible — Fallout. Moore even met his wife, ESPN basketball presenter Betty Zhou, at an event in China staged by Huang. “He made our lives really good,” a former Paramount executive recalls.

Standing around 6 feet tall, with dark-rimmed glasses to match his jet-black hair, a vision of Huang as a flamboyant bon vivant lingers in the minds of those who encountered him. “He was charming as f*ck,” was the summary of one former ally. A master of presentation, he would wield influence with his immaculate English and appreciation of Western cultural nuance, holding court and namedropping during dinners.

“Kenny is immediately likable, a wonderful host and storyteller,” says Mark Johnson, The Holdovers producer who made The Parts You Lose with Huang. “Shortly after I met Kenny he flew me in a private jet to Beijing. Needless to say, I was immediately aware of the extravagance of the trip, a junket to announce our project of Journey to the West, a beloved Chinese story. He was always a gracious and generous host.”

Those familiar with the trip recall walking into a press conference where Huang had erected a giant Journey to the West poster promising that the Paramount movie would be shot in 3D. There was no script, writer or story outline for the feature. It was typical of Huang’s showmanship.

Although Journey to the West was never made, there were tangible outcomes from Huang’s connections. Jiaflix brokered a first-of-its-kind deal with Paramount to film a chunk of Transformers: Age of Extinction in China. Huang presided over an elaborate promotional campaign, helping set up a TV talent contest in China to win a role in the movie. Paramount executives flew out to crown victors including beauty pageant queen Candice Zhao. The movie was a smash hit in the Middle Kingdom, grossing a then-record $320M with the help of marketing power from Huahua Media, a film company chaired by Huang.

He built trust in Hollywood in a way few Chinese outsiders had managed before him, but people recall an enigmatic, mysterious side to his character. Associates are fuzzy on how he had accumulated his wealth, connections and access to investment. Hollywood executives also had only a vague understanding of Huang’s involvement in a series of doomed headline-grabbing sports investment deals.

In 2009, he led a consortium of Chinese investors in agreeing to take a 15% stake in the then LeBron James-led Cleveland Cavaliers, but the deal was never ratified by the NBA after Huang’s investors failed to complete ownership paperwork. Three years later, Huang was in Italy, spearheading a consortium that took a 15% stake in Inter Milan. He was supposed to be installed on the board of the Serie A soccer giant, but within a year of the deal being announced, it collapsed for unclear reasons.

In between the botched deals, Huang made a failed attempt to take over Liverpool, the storied English Premier League club. His £325M ($404M) bid ended in ignominy in 2010 amid reports he had lied under oath about his U.S. university education and business interests. In one of Huang’s last known appearances in the UK, he was chased through the corridors of London’s opulent Grosvenor House hotel by a pack of reporters after he was served with a fraud lawsuit relating to a car import business. The writ was later dismissed by a Miami court.

Paramount experienced first-hand Huang’s penchant for attracting lawsuits. In 2014, the company was sued by Guo Wengui, the Chinese billionaire currently facing trial in the U.S. over a $1B fraud conspiracy. Guo alleged that Paramount failed to honor a product placement deal to feature his seven-star Pangu Plaza hotel in the Transformers film. Paramount sources suspect Huang or his acolytes over-promised Pangu, but the matter was eventually settled. Huang and his Jiaflix co-founders said Pangu’s claims were “false and inaccurate.”

In 2017, Huang was at the center of an ill-fated $1B movie-funding deal between Paramount and Huahua, the financing vehicle he chaired in China. The agreement, which would have funded 25% of the studio’s film slate through 2019, collapsed after less than a year when Huahua missed a payment and China launched a crackdown on capital flight. For some, it would come to symbolize the perils of Paramount’s new-found reliance on China. Paramount declined to comment.

The deal’s collapse coincided with Huang wanting to switch from middleman to self-styled film mogul. His studio, The H Collective, announced itself to the town in June 2017. The “H” was intentionally ambiguous in its meaning, but it would not be a reach to suggest that Huang had hung his initial on the front door.

Huang put roots down in L.A. in December 2017, spending $6.8M on a mini-mansion in the hills. Huang referred to the palatial five-bed property on Stone Canyon Road as his “Bel-Air house.” It boasted a pool, mountain views and a garage stuffed with Huang’s supercar collection, including a Ferrari 488 and a Bentley Continental. Also spending time at the property was his alleged girlfriend Jane Wu, a glamorous Chinese actress. They were pictured together at the Terminator Genisys premiere, where they walked the TCL Chinese Theatre red carpet and rubbed shoulders with Arnold Schwarzenegger. Wu did not respond to a request for comment.

Associates say Huang would drift in and out of town, being vague about business affairs overseas. His trips could extend so long that his assistant at the time would be required to drive his collection of supercars around L.A. to keep them ticking over. Other onerous tasks for the young assistant included house-sitting the Bel-Air home. When in town, Huang would split his time between the house and Shutters on the sand in Santa Monica, where he would stay for days and take meetings.

To understand how Huang would later face allegations that his decadent lifestyle was built on fraud, you have to start with Xander Cage, the extreme sports-loving spy played by Vin Diesel across three xXx movies. The franchise grossed nearly $1B worldwide and built a loyal fanbase in China. Huang was determined to use a fourth xXx movie as a launchpad for THC and, in many ways, he did. What was not known at the time was that THC was allegedly using the brand as bait to con investors out of tens of millions of dollars, according to two separate lawsuits.

Huang told interested parties he had an “option agreement” on xXx and persuaded people that he had cultivated a friendship with Diesel. Several sources recall them hanging out, with one person remembering that Huang needed to be collected from the movie star’s L.A. house because he was too drunk to drive home. Diesel declined to comment.

To secure xXx, Huang had to raise $8M and he convinced Weying Galaxy, a Hong Kong-based investment company that backed Paramount’s Ghost in the Shell, to contribute $6M of the buyout. According to a lawsuit later filed by Weying, it entered into an agreement with THC in April 2018 on the understanding that it was acquiring the totality of the franchise. What Huang had not revealed was that Diesel had a claim to half of xXx.

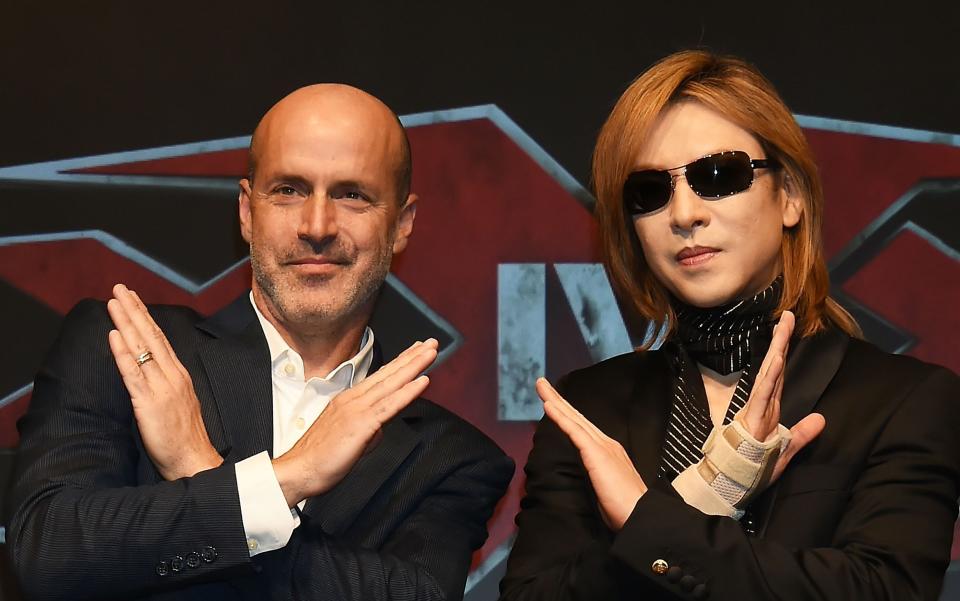

More than a year later, he repeated the same trick with Rakuten, a $12B company known as the Amazon of Japan. Huang established a friendship with Rakuten’s billionaire founder Hiroshi Mikitani and charmed the company into investing millions into xXx in return for a cut of global ticket sales and Japanese distribution rights, per a Rakuten lawsuit unsealed last year. Messages disclosed in the complaint showed Huang personally assuring Mikitani that THC owned “100%” of xXx. This could not have been true based on the deal he had done with Weying.

In short, the strikingly similar lawsuits claim Huang induced Weying and Rakuten to invest in xXx under false pretenses. Weying also alleges that THC raised more than $40M on the back of the franchise, including “unauthorized” product placement and rights deals that were partly funneled through an entity known as Shanghai Puwan Culture Communication. Weying says THC did not share this revenue and failed to provide any records of the investments.

In an interview, Kent Huang says he was unable to answer questions about the “sensitive” lawsuits, but he does not believe THC ever received $40M in investment. He adds that any finance that did hit THC bank accounts was used to fund prep work on xXx. “We were not just collecting money and doing nothing,” Kent claims.

As the messy xXx rights situation burbled away, THC was attempting to mount the fourth movie. Return of Xander Cage helmer D.J. Caruso was hired to direct in 2018 and there was something that resembled a script, though a former THC executive recalls it being a “garbage fire.” Caruso confirmed his involvement but did not comment further. Location scouting and casting were also taking place, with Taiwanese popstar Jay Chou and Chinese actress Zoe Zhang announced as being attached. To xXx’s army of online fans, it looked like all systems go.

Meanwhile, Huang had surrounded himself with established Hollywood executives at THC. In September 2017, he hired Nic Crawley as CEO having met the Brit through Paramount, where he was president of international marketing and distribution. Other senior THC executives included Bad Robot producer Sherryl Clark and Del Mayberry, the longtime CFO of Fox Networks Group. THC set up home in plush Playa Vista offices, where an open-plan industrial space was adorned with movie posters and office-trained pooches.

Crawley’s team was THC’s legitimate front. They knew how to get movies made and, in the early rush to establish credibility, Huang was happy to help facilitate funding. The Parts You Lose was THC’s first flag in the ground, reuniting Paul and Johnson after their Breaking Bad success. “All of our dealings [with Huang] were both professional and transparent,” Johnson comments. “All payments were made on time and in full. There was never any reason to doubt their origins.” This impression was cemented when THC signed with Sony Pictures Worldwide Acquisitions to distribute four features.

The U.S. executives were largely being kept at arm’s length from dealings on xXx and several sources recall being frozen out of discussions about the franchise if they asked too many questions. The Hollywood team did have some involvement in the $8M deal to acquire rights from Revolution Studios in April 2018, though one person recalls being clear that any exploitation was subject to Diesel’s approval. By 2019, there was a physical bifurcation between the U.S. team and xXx, with Kent Huang involved in the project from a separate office in Century City.

As The Parts You Lose was set up in late 2017, Huang opened the door to Gunn, who was shopping Brightburn, a genre-bending superhero script penned by his brother and cousin Brian and Mark Gunn. Fresh from Guardians of the Galaxy Vol. 2’s global take of $863M, Gunn could not direct Brightburn, but he was prepared to produce it for THC.

By Gunn’s telling, he agreed to collaborate on Brightburn during the drive home from a lunch meeting with Huang. It gave THC access to one of the hottest directors in the business and cemented Huang’s burgeoning friendship with Gunn after the pair are said to have bonded over an affinity for cigars. A source says the director was a visitor to Huang’s home in the L.A. hills, but rumors he attended Gunn’s wedding in 2022 are understood to be wide of the mark. Huang did secure a “wish to thank” credit on The Suicide Squad in 2021, long after THC’s collapse. Gunn declined to comment.

When Brightburn wrapped in May 2018, Gunn described THC as the “easiest company I’ve ever worked with,” namechecking Huang and Crawley in an Instagram post. There were high hopes that Brightburn would be a breakout hit that could cement Huang’s status as a genuine force in L.A. A former THC insider says there was a sense of pride among staff: “We got the company up and running, we had some terrific people in place, and we had these projects that were promising.” Sid Ganis, the former Academy president who helped introduce Huang to Hollywood, tells Deadline it was a testament to Huang’s ability to “get things done.”

But Brightburn did not go to plan. Two months after wrapping, Gunn was engulfed in a scandal over historical tweets in which he joked about pedophilia and molestation. He was fired from Guardians of the Galaxy Vol. 3 and THC sources think the crisis scuppered Brightburn’s chances of success, with Sony pushing the premiere back seven months to May 2019.

Brightburn’s bad fortune in late 2018 coincided with Weying making the “shocking discovery” that THC did not acquire 100% of the xXx rights and “never had the ability to do so,” per its lawsuit. The investment company scrambled to rectify the damage by demanding that THC make capital contributions of $3.9M to Xtreme Pictures, the joint venture vehicle established after they acquired the rights to xXx. Weying says THC never paid the money.

THC’s Hollywood team was unaware of the Weying drama, but warning signals were flashing. Multiple sources say THC was late in providing funds for Brightburn wages during the final week of shooting, with Crawley personally stepping in to underwrite paychecks worth around $300,000. THC did pay the CEO back, but there was concern the incident put the company’s credibility at risk. When the movie stuttered at the box office, it was like a “house of cards,” recalls a former THC producer.

The speed of the collapse was spectacular as all of Huang’s problems came to a head in a chaotic 2020. The first card to fall was what should have been THC’s third movie: The Beast, Aaron W. Sala’s desert island survival horror feature starring Morena Baccarin.

The movie was prepping in New Zealand, but people working on the project were getting jitters about funding from Huang. The Beast was location hunting and set building with cash from Rakuten, which had invested in the $20M feature alongside xXx. The Japanese company’s lawsuit says the funding was provided on the promise that THC was already bankrolling the movie. Except it wasn’t. Rakuten and ex-THC insiders say Huang never contributed.

By February, weeks before the pandemic forced the world into a historic lockdown, Huang pulled the plug on The Beast. Some saw Covid as a convenient excuse. THC’s Hollywood team was furloughed, never to be reunited. Employees used to crack office jokes about being ghosted by their Chinese backers, but the black humor was suddenly a reality. “I couldn’t get anyone on the phone, I wasn’t getting paid. It was terrifying,” recalls one ex-staffer.

As THC atomized, Huang disappeared to Asia under a deluge of lawsuits. Crawley and Clark, THC’s CEO and president of production, filed separate complaints alleging that they were owed more than $1M in unpaid wages. In a sworn statement in September 2020, Crawley claimed that THC planned to pay him using $900,000 of funds it was expecting to receive from Rakuten. Four years on, Deadline understands that Crawley and Clark have not been paid. Both declined to comment.

Weying, the Hong Kong investment company that invested in xXx, sued in October 2020 and issued a statement saying it “co-owns the [xXx] rights with Vin Diesel.” THC was not mentioned in Weying’s press release. Weying’s complaint was withdrawn in 2021 without prejudice, meaning it could resurrect the litigation. The company could not be reached for comment.

Weying’s lawsuit proved to be a grim discovery for Rakuten, which would later say that its xXx investment was “premised on lies.” Huang attempted to dismiss Weying’s legal action as “fake news” in pleas to Rakuten executives, but also proposed to refund the company’s investment “just in case.” THC never paid, despite Huang assuring Rakuten boss Mikitani that his money would be returned.

Rakuten sued THC in February 2021 claiming it was the victim of a “crumbling Ponzi scheme.” THC initially contested the lawsuit, but its defense fell away and, in a 2022 Los Angeles Superior Court default judgment, Rakuten was awarded $52M in damages and costs. A Rakuten spokesperson says: “We are glad to see that the court system recognized our position and made a fair and sound judgment in this case.” Sources say it is unlikely that Rakuten ever received a dime from THC. Rakuten declined to comment on payment.

Deadline sent Diesel’s representatives a series of questions about his relationship with Huang, his knowledge about the allegations, and the future of xXx. The actor declined to comment. Rakuten and Weying’s lawsuits do not suggest Diesel was aware of Huang’s activity. Any hope of the billion-dollar franchise returning appears to be buried under litigation.

Elsewhere, THC defaulted on its mortgage obligations on Huang’s Bel-Air home, which was sold in December 2020. THC also failed to pay around $160,000 in rent on two office suites in Century City, according to two separate lawsuits that resulted in default judgments in favor of the plaintiffs. Several sources say THC also owes money to others, including respected Hollywood publicist Dana Archer, who runs DDA and oversaw ad-hoc announcements for THC during its rise and fall. Archer declined to comment.

Those owed money are resigned to never recovering their cash. Rakuten alleges that finances were funneled through entities in the Cayman Islands or diverted to Asia. Kent Huang acknowledges that people are out of pocket. “I have been trying my best to fix some of these issues, but we do need Kenny’s support in this case,” he tells Deadline.

Despite its stained reputation in Hollywood circles the THC brand lives on, with Kent signing off his emails as “co-chairman.” Kent also co-founded with Mark Rau, the CEO of THC’s German subsidiary, a company called H3 Entertainment, which is said to have employees in Dubai and Hong Kong. In an interview with Deadline last September, H3 said it was looking to integrate new technology, including AI, into its production processes, and a Brightburn sequel was mentioned among planned projects. A source close to Gunn says a Brightburn follow-up is not on the cards and it is understood that the Superman director has not seen Huang since 2019.

Other scripts are in limbo. This includes The Remainders, a suspense action movie by John Wick scribe Kolstad, and coming-of-age film The Vineyard set up with Rain Man producer Johnson, which was set to be filmed on a wine estate run by Chalerm Yoovidhya, the billionaire Red Bull owner. Attempts are also being made to extract The Beast from the THC wreckage.

Those who know Huang remain uncertain over whether he had been genuinely deceitful in his pursuit of power in Hollywood, or whether he overreached, overpromised and was unwilling to deal with the consequences. Some think that if Brightburn had been a hit, things would have worked out differently. A seasoned Hollywood executive puts it like this: Huang’s conduct raised little red flags, but he would usually have seemingly valid reasons for his decisions or would eventually deliver on what he promised. Perhaps his luck ran out?

Another senior source thinks the answer lies in China. “My theory is that something suddenly soured in China and he lost access to his capital and connections,” this person speculates. THC employees openly gossiped about Huang falling foul of Chinese authorities and it seems clear that he has not spent much time in his homeland in recent years. Instead, Kent says his brother has bounced between Japan, New York, Hong Kong and Singapore as he has received treatment for cancer.

Huang’s disappearance is a mystery even to Kent, who says he has not been in contact with his former business partner since last October. Kent hopes he would have been told if Kenny had died — but he is not certain. “It’s really concerning, to be honest, I also want to find out what happened,” Kent says. “Partners, investors and shareholders have been chasing me for updates. Unfortunately, there’s nothing we can do with Kenny not responding. That’s really difficult.”

Cautionary tales about out-of-town financiers are not uncommon in Hollywood, but it was the scale and sophistication of the connections forged by Huang that make him stand apart from others. “There’s a lot of people who pull this kind of scheme but no one at a high level ever buys it because there is no real backing,” says a studio executive familiar with Huang’s story. “This is a very specific case of making it to the tops of Paramount, Sony, and others. That’s what makes it unique.”

His absence means all that’s left is an impression of Huang. A fiercely smart, enigmatic figure, who was briefly a colorful presence in the lives of Hollywood luminaries. He wanted to leave his mark on the town, but is better remembered for his taste in wine than his instinct for running a film studio.

Best of Deadline

Step & Repeat Gallery: The Best Red Carpet & Party Photos Of 2024

Hollywood & Media Deaths In 2024: Photo Gallery & Obituaries

2024-25 Awards Season Calendar - Dates For Oscars, Tonys, Guilds, BAFTAs, Spirits & More

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.

Yahoo Finance

Yahoo Finance