Smiling Ivanka grilled on Donald Trump’s net worth in fraud trial testimony

Documents capturing Donald Trump’s allegedly grossly inflated net worth and assets in his real-estate empire are at the heart of a case that threatens to collapse the family business.

Donald Trump Jr and Eric Trump said they had nothing to do with them. The former president downplayed their existence entirely but said he would “look at them” and maybe offer “suggestions”. They blame the accountants, and the accountants blame the Trumps. Michael Cohen also said he was “tasked” with coming up with “whatever number Mr Trump told us to”.

As for Ivanka Trump, the former president’s oldest daughter who stepped away from the family business to join him at the White House, she can’t recall much of anything about emails and documents surrounding favourable business deals under scrutiny from New York’s attorney general.

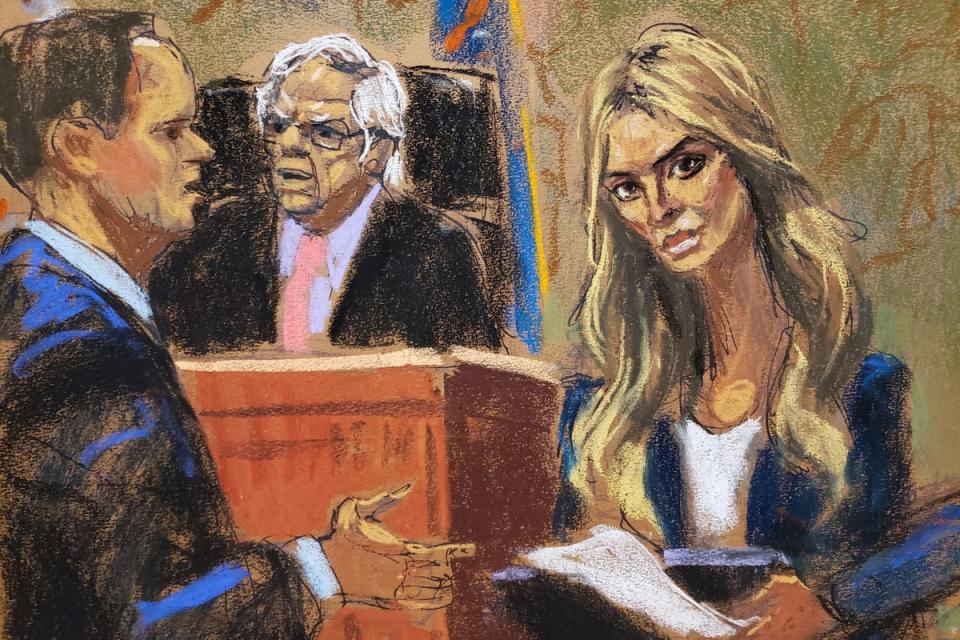

Ms Trump walked briskly into New York Supreme Court on Wednesday morning in a dark suit and smiled as she entered Judge Arthur Engoron’s third-floor courtroom.

Across more than four hours of testimony, Ms Trump spoke softly and deliberately and flashed polite smiles from the witness stand, a stark contrast to her father’s meandering half-finished thoughts in his turbulent courtroom appearance.

Counsel with the office of New York attorney general Letitia James grilled Ms Trump about allegedly fraudulent documents used to secure favourable loans for the family’s brand-building properties, what Ms James has argued the Trumps exploited to enrich themselves and their businesses over a decade.

But Ms Trump distanced herself from those statements when shown her extensive communications with Trump Organization figures, banks, lenders and her husband Jared Kushner about the state of her family’s finances and real estate deals.

“I’m not involved with his personal financial statements,” she told counsel with the attorney general. “I didn’t know about his personal statements, per se, other than what you showed me.”

Asked whether she had “any role” preparing Mr Trump’s statements of financial condition, she said: “Not that I’m aware of.”

She also said she does not recall providing any valuations for Mr Trump’s assets or reviewing any of those statements before they were finalised.

In one email to Deutsche Bank in December 2011, she wrote that “my father and I are very much looking forward to meeting with you” to discuss plans for the Trump National Doral resort in Miami.

The email also included “some basic information on our golf and hotel properties”. She doesn’t remember the meeting.

Her father, who appeared in court on Monday, was initially scheduled to be the headlining final act for the attorney general’s case, following testimony from her brothers last week.

But Ivanka Trump’s failed appeals to block her appearance shifted the attorney general’s witness schedule, making her Ms James’s last chance to put a Trump family member on the stand.

“At the end of the day, this case is about fraudulent statements about the financial condition that she benefited from,” Ms James told reporters and camera crews assembled at the foot of the courthouse steps on Wednesday.

“Despite the fact that she was very, very nice, very friendly, facts basically demonstrate the truth,” she said.

Judge Engoron has already found the defendants liable for fraud. Ms Trump is not one of them.

She hired her own attorney and successfully removed herself as a defendant in the case earlier this year, leaving behind her father and her brothers among the 15 defendants who are being sued for defrauding banks and investors by overvaluing Mr Trump’s net worth and assets to gain more favourable financing terms.

The attorney general’s lawsuit, across more than 200 pages, alleges that Mr Trump and his co-defendants materially overvalued his assets by as much as $2.2bn a year over a decade.

Though she is no longer a defendant, Ms Trump “remains financially and professionally intertwined” with the Trump Organization, according to a recent court filing from the attorney general.

Donald Trump Jr ran a revocable trust to manage his father’s assets while he was in the White House. Eric Trump, meanwhile, ran the Trump Organization’s day-to-day business.

Ivanka Trump, once considered by one of the Trumps’s chief lenders as the “heir apparent” of her father’s empire, left the Trump Organization in 2017 to support her father during his presidency. She previously held an “executive vice president” title shared with her brothers.

But Ms Trump and Mr Kushner have sought to distance themselves from the aftermath of her father’s chaotic presidency. After his election loss in November 2020, the couple moved to Miami with their three children, largely avoiding the limelight and her father’s 2024 ambitions.

According to the lawsuit, “Ms Trump was aware that the transactions included a personal guaranty from Mr Trump that required him to provide annual statements of financial condition”, documents at the centre of the case that were handed over to financial institutions for favourable rates and terms by relying on inflated values of the former president’s assets and net worth.

Evidence presented by the attorney general’s office appeared to show that Deutsche Bank would only agree to finance the Doral project on the condition that Mr Trump cover the principal, interest, and operating income of each asset, along with proof that he had a net worth of at least $3bn.

In one email from 2011, lenders with Deutsche Bank financing the Doral resort in Miami required Mr Trump to maintain a “minimum net worth” of $3bn – excluding “any value” related to his “brand value”.

According to the attorney general, Mr Trump’s net worth at the time was $1.6bn. The Trump Organization claimed on statements of financial condition that it was $4.3bn.

Mr Trump, meanwhile, has repeatedly argued that his statements of financial condition were lower, not inflated, because his “brand” was excluded.

An executive with the Trump Organization responded to Ms Trump’s message about the “net worth” clause with some concerns. “The net worth covenants and DJT indebtedness limitations would seem to be a problem?”

Another 2011 email from the Trump Organization’s David Orowitz to former chief financial officer Allen Weisselberg said that “Ivanka wanted me to change the language around the GAAP section. She asked that I review with you.”

GAAP – or generally accepted business practises – are the guidelines for creating statements of financial condition, the documents at the centre of the case.

The federal government also was concerned with the Trumps’s “multiple GAAP departures” in his statements of financial condition, according to documents reviewing a deal for the Trump Organization to develop an historic Washington DC property. Those concerns were shared with Ms Trump.

But in the first minutes of her testimony, she claimed that she was only “generally familiar” with those guidelines.

“I haven’t thought about GAAP as much since college,” she said.

In 2013, the Trump Organization obtained a ground lease from the federal General Services Administration to redevelop the Old Post Office into a hotel. Ms Trump “captained” the project, according to the attorney general’s office.

The Trumps obtained a $170m loan for construction through Deutsche Bank, which required Mr Trump to certify the accuracy of the statements of financial condition he used to secure the loan.

In May 2022, the Trump Organization sold the property for $375m, a $100m profit, “the result of the loan he was able to obtain by using his false and misleading statements,” according to the complaint.

She made $4m from that sale. “That’s consistent with my recollection, yes,” she said.

Counsel with the attorney general’s office also questioned Ms Trump about a penthouse in Trump Park Avenue, another property that has been heavily scrutinised by investigators.

In 2011, she signed a rental agreement with an option to buy it, writing in her memoir The Trump Card that she paid market value, not an “insider” price.

The lawsuit alleges she had an option to buy it for $8.5m, though the Trump Organization’s financial statements valued the property at $20.82m.