KCK Democrat may break with Gov. Kelly and support GOP tax cuts. ‘What’s my incentive?’

When the Kansas Senate last month passed a sweeping tax package set to cost $1.6 billion over three years that would set a single state income tax rate, Sen. David Haley missed the vote. Icy conditions kept the Kansas City, Kansas, Democrat from the action in Topeka that day.

Haley sits at the center of the action now.

Democratic Gov. Laura Kelly vetoed the Republican-led bill, labeling the flat tax an irresponsible experiment that risks squandering the state’s large cash reserves while benefiting the wealthy over the middle class. The House likely has the votes to override her veto, but in the Senate, Democrats along with two Republicans and a conservative independent opposed to the legislation can uphold the veto if they stick together.

But Haley has said he is 50-50 on the override — very publicly making himself the potential decisive swing vote. In turn, the long-time senator is trying to direct the new attention on him toward his deep frustrations with what he believes is a lack of care and investment in his area by state officials.

That disinvestment, he says, means money lost in state revenues by the GOP plan wouldn’t go to his district anyways.

“$2 billion extra doesn’t mean anything for eastern Wyandotte County. So what’s my incentive?” Haley told The Star recently.

If the Democratic senator votes to override the veto, he will hand Republicans a major legislative victory, allowing a rewrite of the state’s tax code that will affect millions of residents to go forward. He would be dealing Kelly, who first won the governor’s office in 2018 with promises of fiscal responsibility, perhaps the biggest legislative defeat of her tenure.

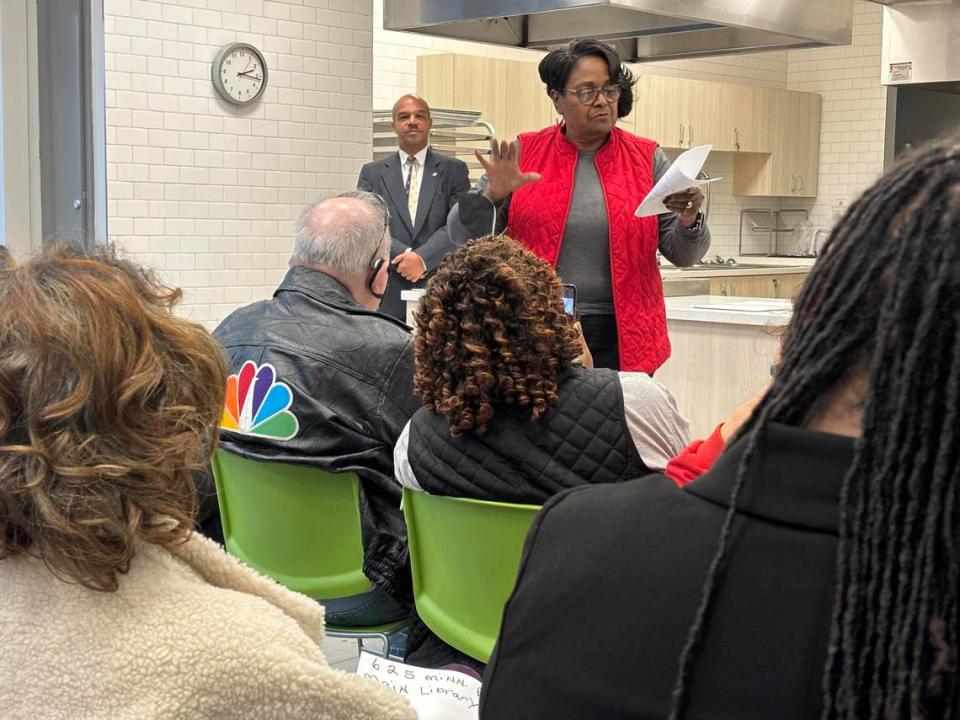

Haley’s open indecision led to an extraordinary scene on Saturday, as Kelly administration officials, the leader of the Kansas Democratic Party and Haley’s own legislative colleagues — along with his own constituents — publicly urged him to vote no on the override during a charged town hall in downtown Kansas City, Kansas.

Kelly’s chief of staff, Will Lawrence, suggested to the crowd of more than 70 who packed into a grocery store meeting room that Haley had been told by Republican leaders that they would kill the bills he wants if he doesn’t support the override. His comments came after Adam Proffitt, the state budget director, delivered a presentation on the GOP plan’s pitfalls, complete with charts.

“Senator, we have your back … the governor has your back,” Lawrence said.

Over two hours, Haley listened as speaker after speaker delivered variations on the same message: Back Kelly and reject the override. A handful urged Haley to support the tax plan, but a show of hands at one point made clear a large majority of those present opposed the measure.

“Do not — do not vote for this flat tax,” Kansas Democratic Party Chair Jeanna Repass said during an impassioned speech that instead urged support for Kelly’s tax plan, which doesn’t include the single income tax rate.

The political peril Haley faces if he crosses Kelly was often implied, but at points made explicit. Kevin Wright, who identified himself as a member of United Auto Workers, told Haley that if he voted for the override, Wright would ensure every union in the area knows.

“I will damn sure make sure it’s out there,” Wright said. “So remember, I voted for you in this spot and please remember that when you go up there. And whatever they’re offering or whatever it is — remember, this seat is here today, gone tomorrow.”

Senate President Ty Masterson, an Andover Republican, said Monday he’s made no threats against Haley. Still, Masterson said the senator could do “some tremendous things for his district” if he voted to override and that items that would normally face resistance could easily pass through the Legislature.

“It’s part of negotiation and deal making in the sense of trying to get things worked out,” Masterson said. “It could really be anything on his mind that he thinks would benefit his district if we think it could get through the chambers.”

Deep frustrations

Haley, who hasn’t said whether he will run for re-election, has been in the Legislature since 1995 and in the Senate since 2001, making him the longest-serving senator. The 65 year old is a well-known figure in Kansas City, Kansas, and the nephew of Alex Haley, the writer of the 1976 novel “Roots.” Haley’s father was also a state lawmaker and in the late 90s and early 2000s was the U.S. ambassador to Gambia.

Over the course of his political career, Haley has pushed for marijuana legalization, criminal justice reforms and has been a consistent voice urging for more investment in eastern Wyandotte County, one of the most racially and ethnically diverse areas in Kansas, and one of the poorest.

The southern edge of his district runs roughly along I-70, and goes north to the Missouri River. North 83rd Street roughly marks the western border. The district is 37% white and 43% Black. About 24% are Hispanic. In Wyandotte County as a whole, 16% of residents live in poverty.

Given his decades as a stalwart Democratic presence in Wyandotte County and in the Kansas Capitol, Haley’s public waffling is confounding some Democrats, who wonder whether he is sincere or bluffing to some other end. But Haley attributes his ambivalence to a belief that a single rate state income tax could make Kansas a more attractive state in the long run, and a belief that the lost revenue won’t prove devastating.

“I just am not of the opinion that the sky will fall if this bill passes. I do believe there will be a significant drop in revenue,” Haley said in an interview prior to the town hall.

The plan would exempt from the state income tax the first $6,150 in income for individuals and $12,300 for couples, eliminating taxes for some while reducing the portion of income taxed for the state’s lowest earners. Republicans have argued those cuts provide the most benefits to low-income Kansans, especially in Haley’s district.

Masterson dismissed the opposition among many of Haley’s constituents at his town hall as misinformation. “If the district really knew what the bill did and how it benefited his district I think he would have massive groundswell support for it,” he said.

Alongside the 5.25% flat income tax rate the bill also cuts sales tax on food alongside property taxes while increasing overall tax deductions. An analysis from budget officials in the Kelly administration indicates the policy would lead to a $500 million budget shortfall by 2029.

Lost revenue, Haley said, would not impact eastern Wyandotte County where, he says, governor after governor has failed to deliver significant investments.

“What’s in it for the longest-serving Kansas senator who has no bright, shiny destination tourism, or even a decent restaurant, to bring people out of town to visit because the state has done nothing?” he said.

Haley has floated funding for Kaw Point, where Lewis and Clark camped in 1804 and the Quindaro township, a Civil War-era boom town, as key opportunities for attractions in his district that had instead been ignored.

Haley said he had met with leaders on both sides of the override debate but that he had not asked for or been offered anything in exchange for a vote. His desire for economic development in his district, he said, is “no secret.”

“You have the other side to contend with,” said Haley, who is considering retiring after this year.

“There’s nothing tangible that Laura Kelly can do now or that the legislative Republican leadership can do right now, in February, that the other side – if they got wind that that’s what David Haley wanted – that they wouldn’t work to defeat.”

Haley told The Star on Monday he was still considering how he would vote.

Haley’s comments reflect a deep frustration within Wyandotte County among residents who feel the Republican-controlled Legislature for years has either ignored or even harmed their community.

In 2022 the Legislature split the county for the first time in decades when it drew new congressional districts. Kelly also signed a bill that effectively overturned a sanctuary city policy local activists had worked years to see passed.

On the Senate floor, Haley has repeatedly expressed frustration with a state government that he views as spending money developing western Wyandotte County while sending little to none to the impoverished areas on the county’s northeast edge.

Stephon King, a Kansas City, Kansas, resident who helped organize Haley’s town hall said the senator was brave to go before his constituents in the current moment. King didn’t say how he thought Haley should vote on the tax policy, but said the senator was in a lose-lose situation.

If Haley votes to uphold the veto, King said, Kelly could take all the credit and Republicans could block his priorities for the rest of the year. If he votes with Republicans, Haley will be shunned by his own party.

King pointed to Haley’s colleague in the Legislature, Rep. Marvin Robinson, a Kansas City, Kansas, Democrat who delivered key votes to Republicans last year. Republicans included $250,000 in the state budget for the Quindaro Ruins but Kelly vetoed the funding (the Kansas Department of Commerce later secured $1 million for the Quindaro Ruins as part of a tax compromise with the parent company of Sporting KC).

“It’s bigger than the state tax bill, what he’s trying to say is bigger than a state tax bill but they won’t listen because we’re in a party divide,” King said. “There’s a lot of pressure on him.”

The question, King said, should be what Republicans and Kelly have done to earn Haley’s vote and why measures he crafts to help his community are often left untouched.

A ‘power position’

While many in Wyandotte County agree with Haley that his district has been underserved, voting with Republicans to override Kelly’s veto would provoke a backlash – and raise the possibility of a primary challenge if Haley runs for re-election. As of Monday, no one has filed to run for the seat.

Marcus Winn, a community activist, said Haley may have a “noble” end of getting resources for Wyandotte County. But voting for a tax cut that largely benefits the most wealthy Kansans, he said, isn’t the way to accomplish his goal.

“Nothing good is going to come of this, just more disinvestment,” Winn said. “This seems like sour grapes that is just like if we can’t get what we want we’ll just burn everything down.”

Concerned Voters of Wyandotte County have been writing letters to Haley urging him to vote to sustain Kelly’s veto. The group argues the tax plan is too skewed toward the wealthy rather than low-income residents who live in Haley’s district.

Mike Taylor, the group’s lobbyist and a former longtime lobbyist for the Unified Government of Wyandotte County and Kansas City, Kansas, said he believed Haley will ultimately vote to sustain Kelly’s veto.

Haley has put himself in a position where the Kelly administration may be reaching out to him, asking how he can be convinced to side with the governor, he said.

“He’s put himself in a power position,” Taylor said, “because he’s getting courted a lot by both sides.”