Netflix Faces a Tough Balance as It Kicks Off Hollywood Earnings Amid a Double Strike | Charts

You are reading an exclusive WrapPRO article for free. Want to level up your entertainment career? Subscribe to WrapPRO.

Netflix is the first major streamer to report quarterly earnings to Wall Street amid Hollywood’s historic double strike. On Wednesday, analysts will be keenly watching to see how co-CEOs Ted Sarandos and Greg Peters present what investors hope will be a return to growth as its ad tier and password-sharing crackdown spur new subscriptions.

Striking writers and actors will be looking, too, as they argue for what they say is a fair share of profits from streaming.

The direct effects of the first double strike in more than 60 years won’t be visible in the June quarter, which ended before talks between the studios and SAG-AFTRA broke down. But Sarandos and Peters will likely face questions about the impact on the company’s financials and strategy in the months ahead.

Their answers may face sharp retorts on the picket lines forming from coast to coast.

“Be careful talking out of both sides of your mouth,” SAG-AFTRA New York Local Vice President Linda Powell warned media executives in a conversation with TheWrap. “Because if you go over there and tell [shareholders], ‘Look how well we’re doing. We’re looking forward to being profitable next year,’ then don’t come back to us and tell us you don’t have enough money to pay us what we’re worth.”

Also Read:

‘Jig Is Up!': Inside the Blistering Hot First Day of Hollywood’s Double Strike | Video

Indeed, analysts surveyed by Zacks expect Netflix to report substantial profits, with earnings per share of $2.82 on revenue of $8.26 billion. On Monday, its stock price hit levels it hasn’t seen since January 2022, with shares up 52% year to date.

“This run makes it vulnerable to any miss or weak guidance,” Real Talk Capital CEO Rob Luna told TheWrap. “This being said, for investors with a longer-term perspective, any pull-back should be bought.”

New restrictions on sharing passwords and a cheaper version of its service with ads seem to be drawing new subscribers to Netflix. At the end of the first quarter of 2023, Netflix boasted a total of 232.5 million subscribers globally. During its upfront presentation in May, the company revealed that the Basic With Ads tier had grown to nearly 5 million monthly active users globally.

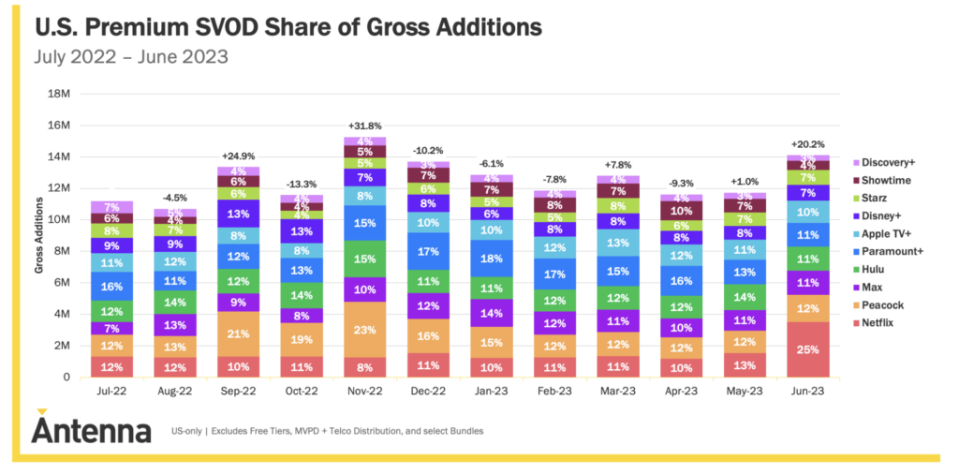

According to data from Antenna, Netflix had over 3.5 million gross subscriber additions in June alone, the largest month of acquisition the firm has ever measured for the service.

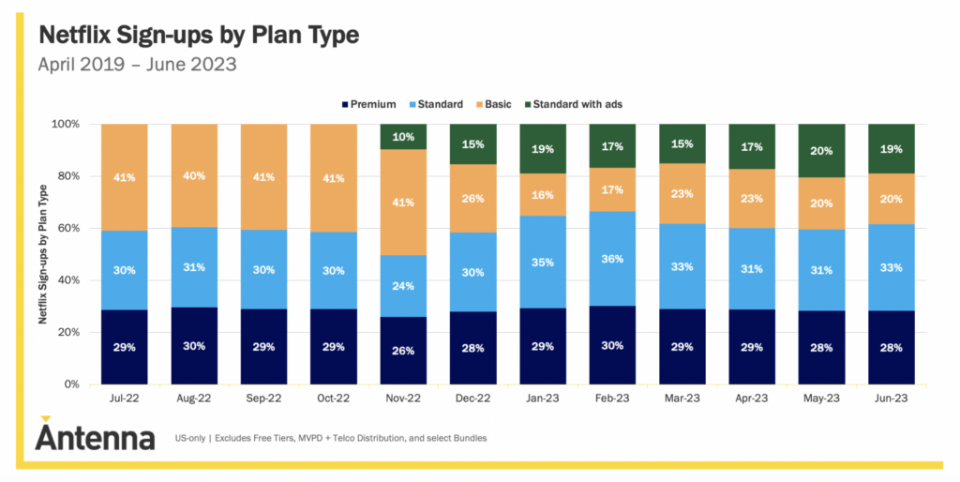

The research firm estimated that one out of every four premium SVOD sign-ups in June went to Netflix, with its ad-supported plan accounting for roughly a fifth of Netflix sign-ups in recent months.

Cancellations for the service were also up during the month, but at a much lower rate than gross additions. In June, the ratio of gross additions to cancellations for Netflix, a key measure of success in attracting and retaining subscribers, reached its highest level since early in the COVID lockdowns in April 2020, Antenna said.

Netflix’s ad-supported tier will “drive significant revenue for the company over the coming years that is likely underestimated by most analysts,” Luna said. The password crackdown may also drive people who were previously getting Netflix for free to opt for the lowest-price subscription.

Paid sharing will result in an incremental $900 million in revenue for Netflix in 2023, $3.4 billion in 2024 and $4.5 billion in 2025, Deutsche Bank analyst Bryan Kraft predicted. Advertising will contribute $400 million in 2023, $1.3 billion in 2024, $2.3 billion in 2025 and $6 billion in 2030, according to the bank’s estimates.

“We believe Netflix is one of the few clean earnings and [free cash flow] growth stories in media and communications,” Kraft wrote in a note to clients on Monday. “All of the headwinds to traditional media are effectively tailwinds for Netflix.”

Also Read:

Hollywood Moguls Bask in Sun Valley Luxury While the Industry Shuts Down

Wedbush Securities, which maintains an outperform rating and $475 price target on Netflix stock, believes the company has “reached the right formula with its global content to balance costs and generate increasing profitability.”

“We think Netflix is well-positioned in this murky environment as streamers are shifting strategy, and should be valued as an immensely profitable, slow-growth company,” Wedbush analyst Michael Pachter wrote in a note to clients on Friday.

Netflix’s report, which kicks off earnings season in the media sector, will unfold as the Writers Guild of America has been on strike since May 2 and SAG-AFTRA launched its own strike on Friday.

“Everyone will be looking at the impact the WGA strike had on content spend” and Netflix’s view going forward on negotiations with the unions, Gerber Kawasaki managing partner Hatem Dhiab told TheWrap.

The strike will “enhance Netflix’s competitive advantage given its level of unreleased content and its global production capabilities,” said Loop Capital analyst Alan Gould.

Dhiab expects Netflix to move more of its content production and spend internationally in an effort to get around the American unions.

Also Read:

Actors vs. Studios: What the 2 Sides Say Were the Sticking Points That Led to the Strike

“This will hurt Hollywood long-term unfortunately,” he said.

While Wall Street appears to be shrugging off any near-term impacts of the strike, SAG-AFTRA leadership warned Netflix not to underestimate the unions’ resolve and unity.

“We want them to hurt as much as we are going to hurt to do this strike action. It is extreme. It is our last resort,” SAG-AFTRA New York Local president Ezra Knight told TheWrap. “But if it hurts their bottom line, that is our message to them: that we matter, that we affect your bottom line.”

The WGA has previously estimated that its proposals would collectively cost the industry $429 million, with $343 million of that directly attributable to AMPTP’s member studios. Of that total, it estimates that Netflix would pay an additional $68 million, or 0.2% of its $31.6 billion annual revenue. SAG-AFTRA hasn’t yet released a similar breakdown of its proposals’ costs to studios.

“These CEOs are making millions and millions as their annual salary and on top of that millions of dollars in bonuses,” SAG-AFTRA Los Angeles board member Michelle Hurd told TheWrap. “We’re not asking for bonuses, we’re asking for a living wage. So I do hope everybody looks at those numbers with a real sober eye, because we look at our salaries and it’s painful.”