Russia’s Crude Shipments Hit a Three-Month High as Cuts Tapered

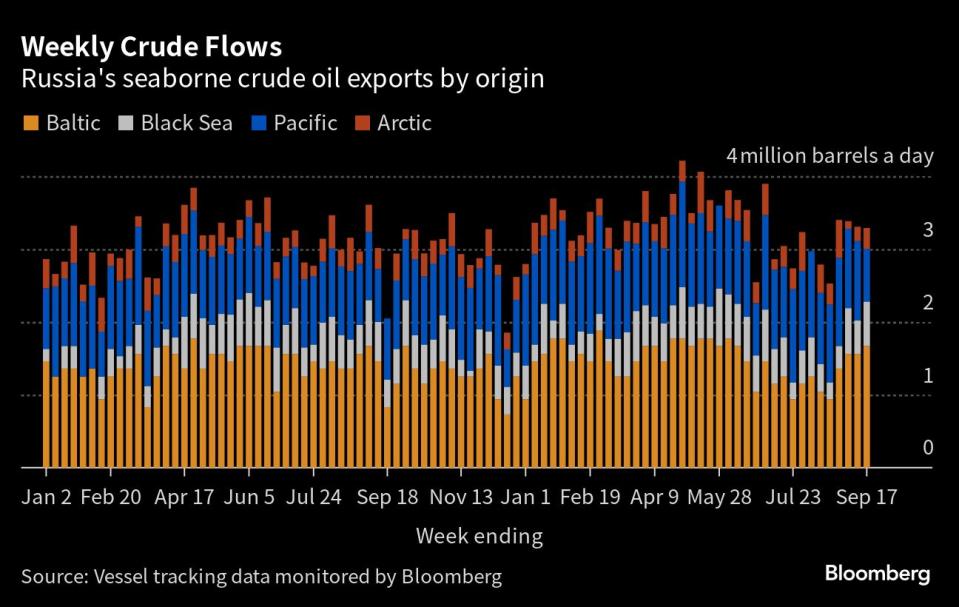

(Bloomberg) -- Moscow is pushing more crude onto the market even as it says it will extend supply curbs to the end of the year along with OPEC+ partner Saudi Arabia. That’s boosted Russia’s seaborne flows to a three-month high.

Most Read from Bloomberg

Vegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the Making

Dollar Rally Is Crushing One of the Most Popular Trades of 2023

F-35 Debris Found After a $100 Million Fighter Jet Went Missing

Average nationwide shipments in the four weeks to Sept. 17 rose to 3.34 million barrels a day, tanker-tracking data compiled by Bloomberg show. That’s a jump of about 465,000 barrels a day from the period to Aug. 20, with the increases concentrated at the Baltic ports of Primorsk and Ust-Luga and Novorossiysk on the Black Sea.

Some increase in Russia’s crude exports was to be expected. Deputy Prime Minister Alexander Novak said early last month that Russia would extend its export cut, while tapering it to 300,000 barrels a day from September, compared with 500,000 barrels a day in August. But shipments have risen by more than twice as much as implied by Novak’s statement.

More volatile weekly shipments edged lower in the seven days to Sept. 17, driven down by a brief mid-week halt to flows from the Pacific port of Kozmino, which appears to have been related to maintenance work at the terminal.

The export boost comes as crude prices are being driven higher by a combination of robust demand and output cuts by key producers — most notably Saudi Arabia. The kingdom has pledged to keep its production below 9 million barrels a day until the end of the year, the lowest its target has been since 2011, excluding the response to the Covid-19 pandemic in 2020. Saudi Arabia's early September announcement was mirrored by Russia, which committed to maintaining its export reduction to year-end.

Brent crude is trading around $95 a barrel, while Russia’s key Urals export grade has been above a Group of Seven price cap of $60 a barrel since mid-July. Cargoes sold at prices above the cap — part of a Western sanctions package designed to punish Moscow for the invasion of Ukraine — cannot be shipped on Western vessels, while insurance and other services can’t be provided by Western companies. That’s forcing Russian crude onto the country’s own ships and a “shadow fleet” of vessels, owned by little-known companies that have sprung up since Moscow’s troops invaded Ukraine in February 2022.

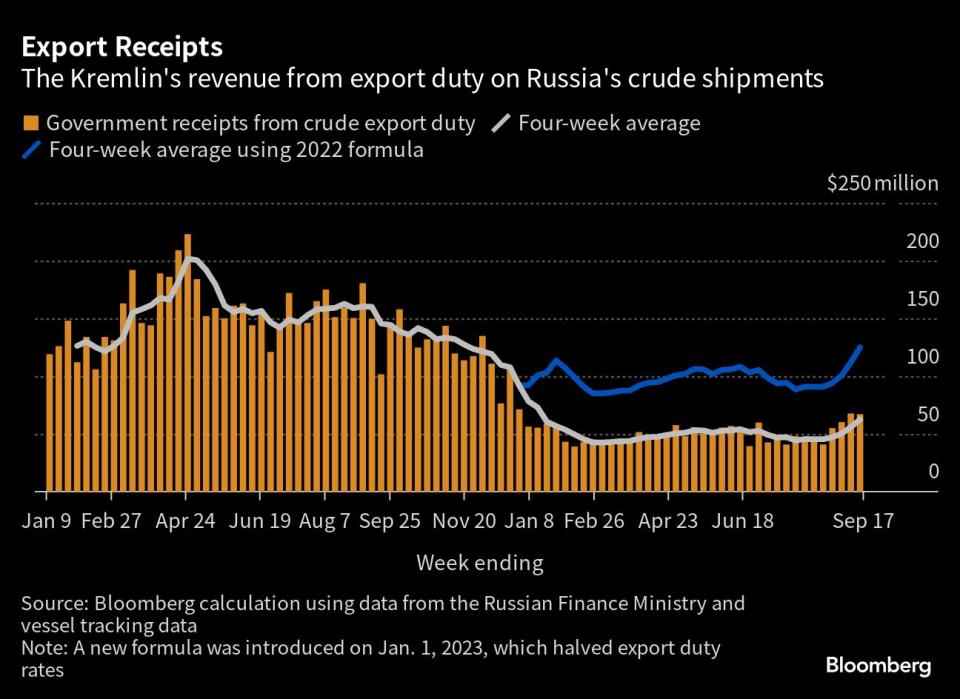

The combination of rising exports and soaring prices have boosted the Kremlin’s revenues from oil export duties, which surged to the highest since January on a four-week average basis.

The jump in overseas flows of Russian crude comes as the country’s oil refineries cut crude-processing rates, with seasonal maintenance at the facilities gathering pace.

Flows by Destination

Russia’s seaborne crude flows continued to recover in the period to Sept. 17 on a four-week average basis. Flows averaged 3.34 million barrels a day, their highest in 11 weeks. Shipments are back at the levels seen in February, the original baseline for Russia’s output cut, but they remain about 390,000 barrels a day below the highs seen between April and June.

Most of the increase in the past month is on tankers that are yet to show a final destination. Flows on vessels heading to Asian ports remain more than 1 million barrels a day below their mid-May peak.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose for a fourth week to reach 2.86 million barrels a day in the four weeks to Sept. 17, up from 2.74 million barrels a day in the period to Sept. 10 and from a seven-month low of 2.55 million barrels a day in the period to Aug. 27.

Most of the cargoes on ships without an initial destination eventually end up in India. Even so, the volumes heading to the country that has become the biggest buyer of Russia’s seaborne crude are down from recent highs. Adding the “Unknown Asia” and “Other Unknown” volumes to the total for India gives a figure of 1.8 million barrels a day in the four weeks to Sept. 17, down from a high of 2.15 million barrels a day in the period to May 21, but up from 1.66 million barrels a day in the period to Sept. 10.

The equivalent of 505,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or which already have been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 324,000 barrels a day in the four weeks to Sept. 17, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean.

Europe

Most Read from Bloomberg

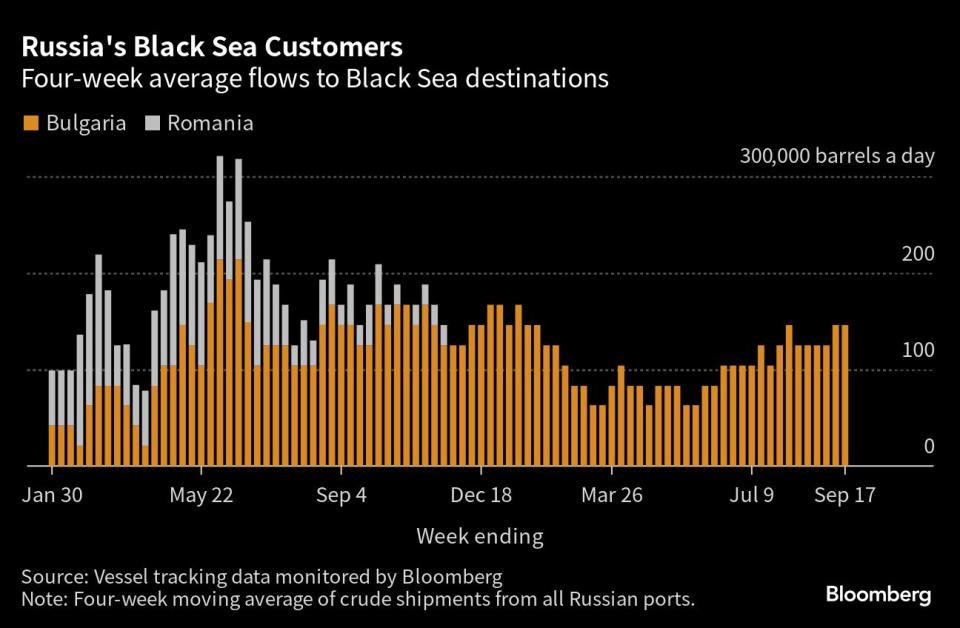

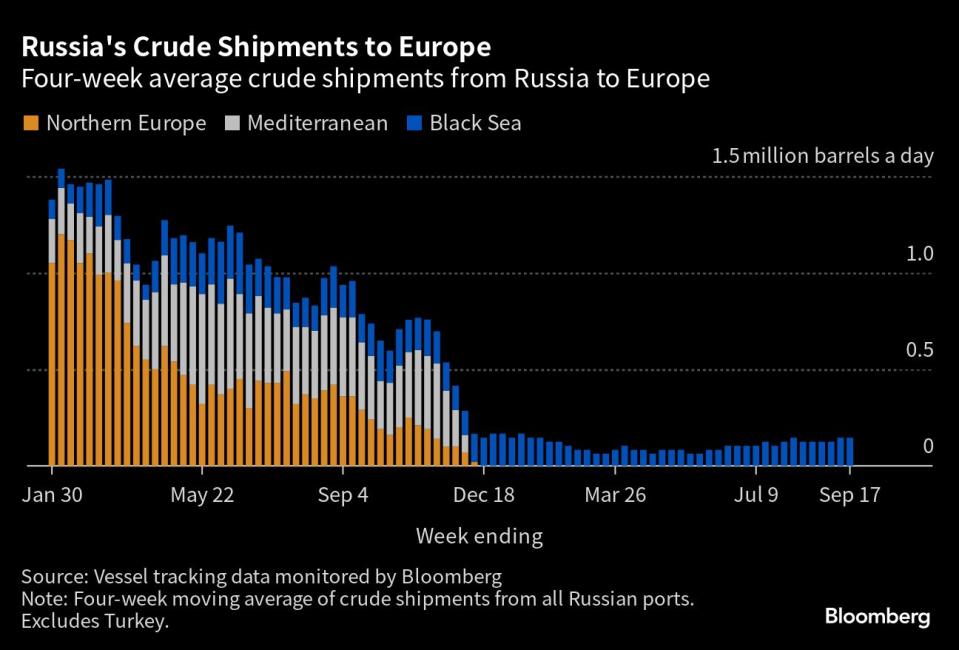

Russia’s seaborne crude exports to European countries were unchanged at 146,000 barrels a day in the 28 days to Sept. 17, with Bulgaria the sole destination. These figures do not include shipments to Turkey.

A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to Sept. 17.

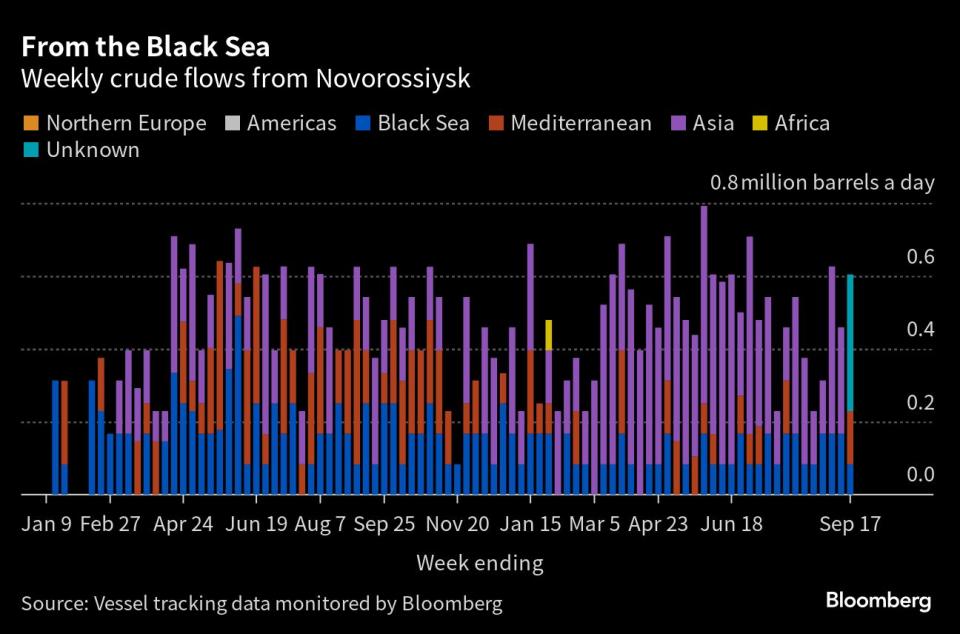

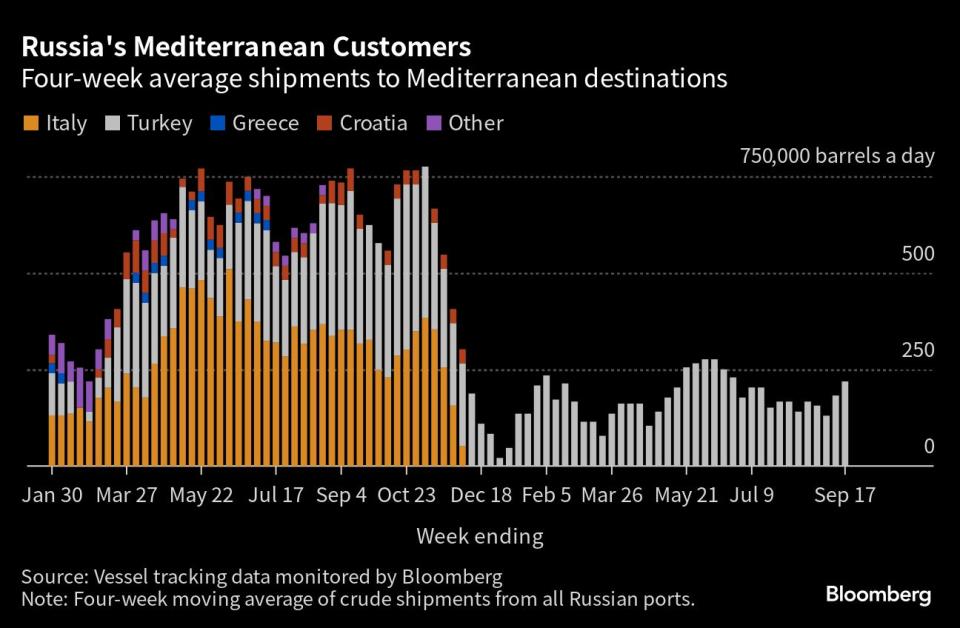

Exports to Turkey, Russia’s only remaining Mediterranean customer, rose to about 220,000 barrels a day in the four weeks to Sept. 17, the highest since June. Flows had topped 425,000 barrels a day in October, before falling sharply after the Group of Seven price cap came into effect in early December.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, were unchanged at 146,000 barrels a day. That’s more than twice as much as the country was importing at the lowest points between March and May and equal to the highest levels seen since January.

Flows by Export Location

Aggregate flows of Russian crude remained above 3.25 million barrels a day for a fourth week in the seven days to Sept. 17, as Moscow eases back on the export cut it implemented in July and most of August.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty edged lower to $67 million in the seven days to Sept. 17, but four-week average income rose to $62.5 million, its highest level in eight months. Rising oil prices and the rebound in flows are both contributing to the increase in receipts.

Russia’s government calculates oil taxes — including export duty — using a discount to global benchmark Brent, which sets the floor price for the nation’s crude for budget purposes. If Russian oil trades above that threshold, the Finance Ministry uses the market price for tax calculations, as has been the case in recent months. The discount used to calculate taxes including export duty is set at $20 a barrel for September and subsequent months.

The duty rate for September has been set at $2.92 a barrel, based on an average Urals price of $70.33 during the calculation period between July 15 and Aug. 14. That was $13.90 a barrel below Brent during the same dates.

The rate for October has been set at $3.26 a barrel, based on an average Urals price of $77.03 during the calculation period between Aug. 15 and Sept. 14. That was $11.60 a barrel below Brent over the same period. October’s duty rate sets a new high for the year.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

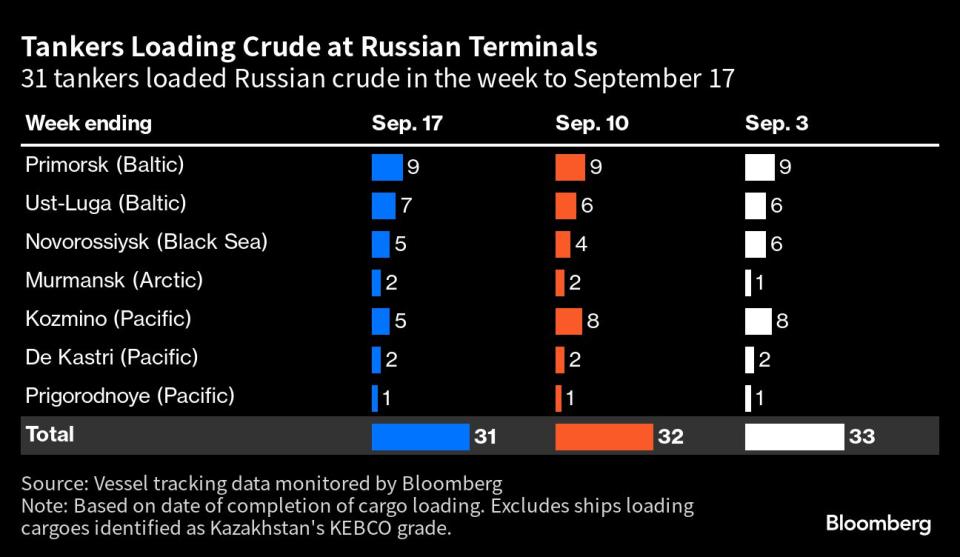

A total of 31 tankers loaded 23 million barrels of Russian crude in the week to Sept. 17, vessel-tracking data and port agent reports show. That’s down slightly from the previous week’s figure.

Shipments increased from all three western regions, but were offset by a dip in flows from the Pacific port of Kozmino.

Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from the Baltic terminals rose to a three-month high of 1.67 million barrels a day. No cargoes of Kazakh crude were loaded at Ust-Luga during the week. Shipments from the Baltic have remained above 1.5 million barrels a day for three weeks and were about 100,000 barrels a day below the highs seen in April and May.

Shipments of Russian crude from Novorossiysk also increased, recovering most of the previous week’s loss. Shipments have recovered to the average levels seen before the dip in flows that began in July.

One cargo of Kazakh crude was also loaded at the port during the week.

Two Suezmax tankers completed loading cargoes at the Arctic port of Murmansk in the week to Sept. 17, boosting flows to a four-week high.

One tanker that loaded in the week to Sept. 17 is headed to Brazil, the third vessel to make the journey across the Atlantic since late August.

Eight tankers loaded at Russia’s three Pacific export terminals, down by three from the previous week. The volume of crude shipped from the region slumped to a 12-week low of 724,000 barrels a day.

The drop in flows was driven by a brief halt to operations at Kozmino, with no ships completing cargo loadings between the 12th and the 16th.

Shipments from the Sakhalin Island terminal continue to be affected by maintenance at one of the Sakhalin 2 project’s oil production platforms. The work is set to run until September. One vessel loaded a partial cargo of Sakhalin Blend crude from the terminal last week.

The volumes heading to unknown destinations are Sokol cargoes that recently have been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri. Most of these are ending up in India.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. Weeks run from Monday to Sunday. The next update will be on Tuesday, Sept. 26.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.