How strong is Central Kentucky’s housing market going into 2024? What buyers can expect

Was 2023 a good year to buy a house in Central Kentucky?

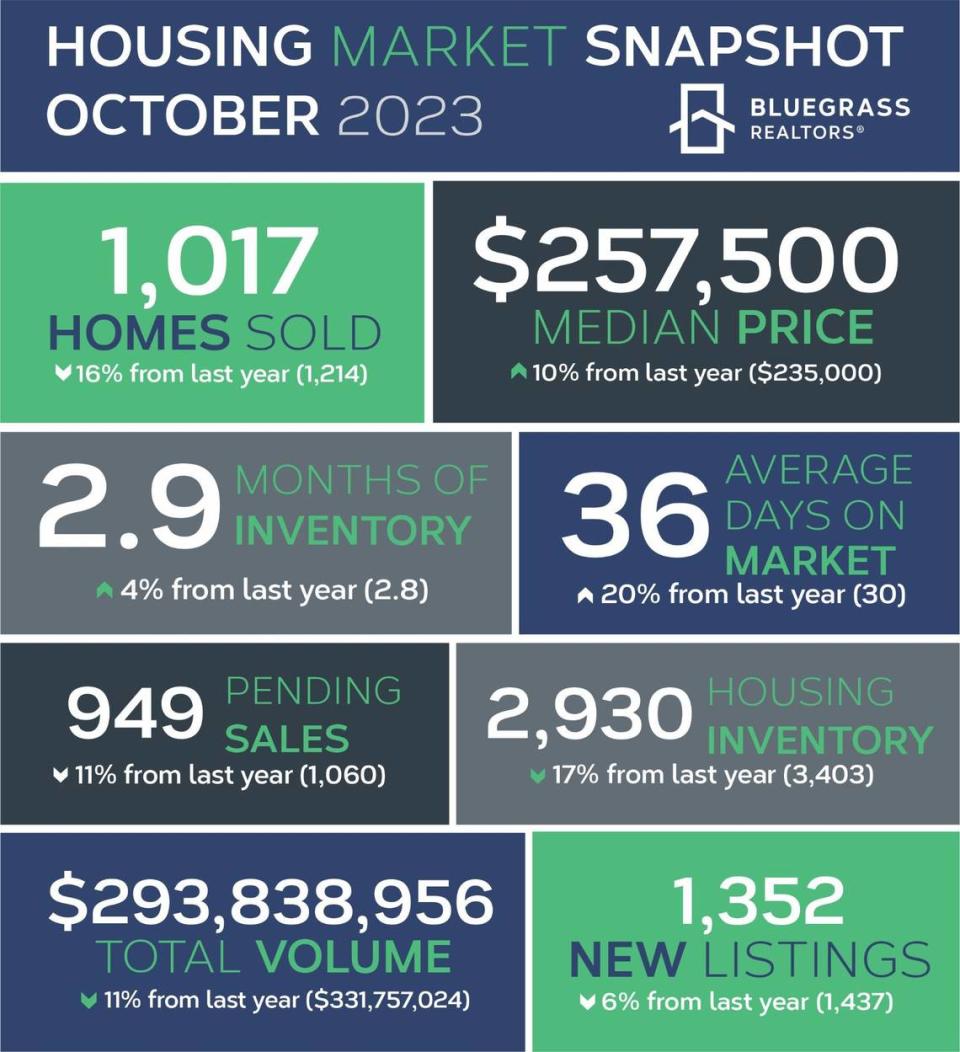

In terms of home sales, the region doesn’t seem likely to finish the year strong if the latest market analysis from Bluegrass Realtors is any sign.

According to the association, whose members represent 30 counties across Central Kentucky, pending sales for the month of October dropped to their lowest point since 2014. Bluegrass Realtors reported just 949 homes under contract that month, marking an 11% dip from the previous year.

A similar trend played out at the national level, with the National Association of Realtors reporting existing home sales dipped 4% in October to a seasonally-adjusted rate of 3.79 million. That represents a sales slump of 14.6% compared to one year ago, according to the NAR.

The decline was likely driven by surging interest rates. The average rate for a 30-year fixed mortgage climbed close to 8% by the end of October, according to CNN.

‘Thrown to the wolves.’ Investors rule Lexington’s housing market. Locals get what’s left.

Still, rates have started to soften. The Mortgage Bankers Association recently issued a sunny outlook, predicting rates will fall to about 6% by the end of 2024 and to 5.5% by early 2025.

One might expect high borrowing rates to curb demand and drive down home prices, however, Bluegrass Realtors reports the opposite is true in Central Kentucky. October marked the 56th consecutive month of year-over-year price growth. That month saw year-over-year price growth of 10%, according to the local association.

The growth is reflected in the median, or middle-of-the-road, price for a home in October. Across Central Kentucky, the median home price reached $257,000, an all-time monthly high and about 10% higher than the same time in 2022, when the median price was $235,000.

According to Bluegrass Realtors, single-family homes peaked at median price of $256,300 in October, and for townhomes and condominiums, that price was $265,000.

In Fayette County, the median home price in October was $325,000, up from $300,000 in the same month in 2022, according to figures from Bluegrass Realtors. It’s worth remembering the median price is just the midpoint, you could end up paying less or more.

The Lexington-Fayette County area is firmly a seller’s market, meaning market conditions favor homeowners putting their homes up for sale, rather than buyers looking to own.

Should you buy a house or wait for interest rates to come down?

So should you wait out lower interest rates before you buy? The answer to that question will largely depend on your financial situation and whether you want to live in Central Kentucky long term.

The next year or two will likely see declining rates for mortgages, and you might be able to get a home loan at a lower interest rate. However, you’re probably not the only prospective buyer making this calculation.

In a statement to the Herald-Leader, Bluegrass Realtors made the case that homebuyers might face stiffer competition if interest rates drop and more buyers return to the market. Additionally, with a surge in demand, prices could also increase.

Lower interest rates may also entice more homeowners to sell their homes, given they’d also be able to take advantage of the lower interest rates when buying a new home. It’s difficult to predict whether that additional housing inventory would offset the increased demand fueled by interest rate cuts.

Kelly Nisbet, president of Bluegrass Realtors, said in comments to the Herald-Leader, “getting into the market now rather than waiting, even though rates are still a little higher than what has been the norm over the past couple of years, could be an easier journey for a lot of people.”

Nisbet added, “it allows buyers to find the right home without the hassle of increased competition and avoiding what is almost certainly going to be higher home prices going into next year. If rates continue to drop, refinancing is always an option to lower rates and mortgage payments. Lower rates will bring out a group of buyers that have been waiting on the sidelines, possibly creating bidding wars with more competition and ultimately pushing up prices.”

On the other hand, some economists point out market conditions just aren’t favorable enough for most would-be homebuyers.

“This is not the time to buy for most people,” Mark Zandi, the chief economist of Moody’s Analytics, recently told New York Times writer David Leonhardt. “Mortgage rates are extra high, and house prices are extra high, and there’s not much to choose from in the market.”

Do you have a question about the housing market in Kentucky? We’d like to hear from you. Submit it via the Know Your Kentucky form below or email us at ask@herald-leader.com.