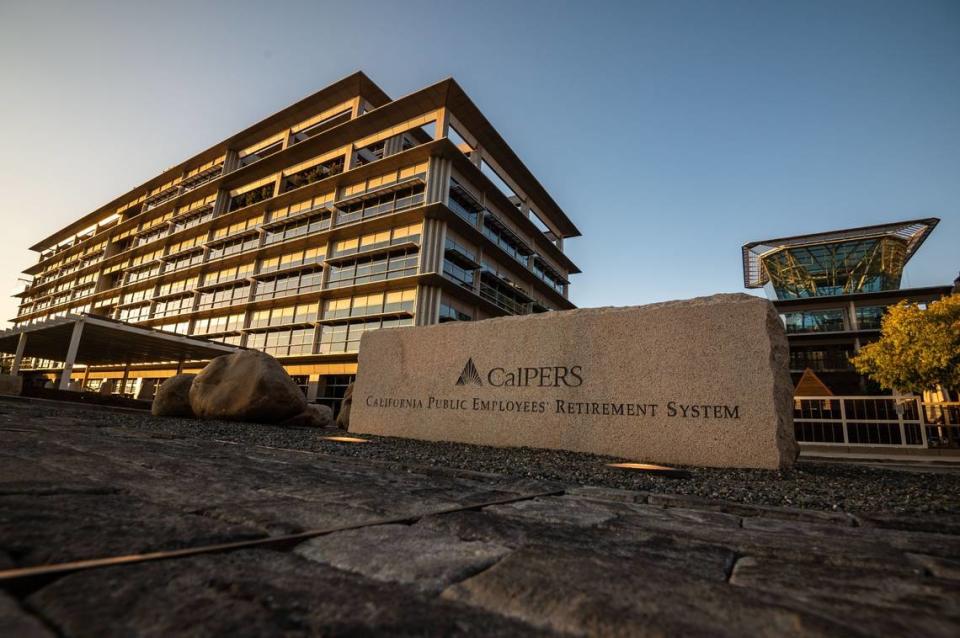

It’s time for the legislature to require CalPERS, CalSTRS to divest from fossil fuels | Opinion

CalPERS and CalSTRS are essentially saying they don’t want the legislature telling them what to do. It’s a strange response to the growing number of Californians that want to phase out fossil fuels.

Senate Bill 252, the Fossil Fuel Divestment Act, authored by Sen. Lena Gonzalez, D-Long Beach, Sen. Henry Stern, D-Calabasas, and Sen. Scott Wiener, D-San Francisco, would require the California Public Employees’ Retirement System and the California State Teachers’ Retirement system to divest their combined $15 billion in the world’s largest 200 fossil fuel companies.

Fossil fuel divestment is a global movement in response to fossil fuel companies using their tremendous political power to block desperately needed climate legislation around the globe and right here in California. In 2020, the University of California system became the largest U.S. school to divest from fossil fuel companies.

No one likes to be told what to do, but the hard truth is that everyone needs oversight and no one is above the law. All citizens, businesses and state agencies have to abide by decisions of the Legislature. CalPERS and CalSTRS aren’t any different. The state constitution explicitly states that ”The Legislature may by statute continue to prohibit certain investments by a retirement board where it is in the public interest to do so.” And fighting climate change by divesting from fossil fuels is clearly in the public interest.

Opinion

SB 252 explicitly says the pension boards do not need to divest if the board determines that divestment is not “consistent with the fiduciary responsibilities of the board.” The bill also gives CalPERS and CalSTRS until 2031 to divest, so they have plenty of time to make sound financial decisions, and the bill extends that time in the case of a major event, such as a war.

CalPERS divested from companies doing business in Apartheid South Africa because profiting from racial oppression was wrong, and they divested from tobacco companies because knowingly selling and promoting a product that causes cancer is immoral.

The pensions have had more than a decade to deal with the issue of fossil fuel divestment, but they have failed to act. Instead, they have preferred the fantasy of shareholder engagement. While engaging with companies is a reasonable approach to bring about small changes, it does not work to change a company’s basic business model, and it has been a complete failure with regard to fossil fuel companies and climate change. The major oil companies have all but abandoned most pretenses of sustainability and are doubling down on increasing production.

A University of Waterloo study found that between 2012 and 2022, CalPERS and CalSTRS would have gained close to $10 billion dollars collectively if they had divested from fossil fuels. The International Energy Agency has concluded that 90% of coal and nearly 60% of all oil and gas reserves must remain in the ground if we are to have at least a 50% chance of keeping global heating below 1.5 degrees Celsius. This means that, at some point, these assets will become stranded. That’s why when the UC divested its endowment and employee pension fund, it said: “We believe hanging on to fossil fuel assets is a financial risk.”

There are some reasonable grounds for caution in the relationship between the Legislature and the pension boards. In 1991, Gov. Pete Wilson, facing a budget deficit, tried to temporarily redirect some pension funding. Public employees fought back and passed a ballot initiative (Proposition 162) putting language in the state constitution to protect the pensions. But the legislature requiring divestment for the public interest is exactly the type of good governance oversight that we need.

For the well being of the planet and the financial health of the pensions, the state legislature must require CalPERS and CalSTRS to divest from fossil fuels.

Carlos Davidson is a professor emeritus of environmental studies at San Francisco State University, a member of the California Faculty Association and a CalPERS pensioner.