U.S. central bank hikes benchmark interest rate by largest amount in 22 years

The U.S. central bank showed its resolve to bring down the highest inflation rate in 40 years by raising its own benchmark lending rate by the largest amount in 22 years.

The Federal Reserve raised its benchmark lending rate to a range of between 0.75 and one per cent on Wednesday. That's an increase of half a percentage point from where it was before, and the biggest increase to the rate since the year 2000.

Central banks slashed their lending rates in the early days of the pandemic in order to stimulate the economy, but those low rates have been a contributing factor to inflation roaring back in recent months.

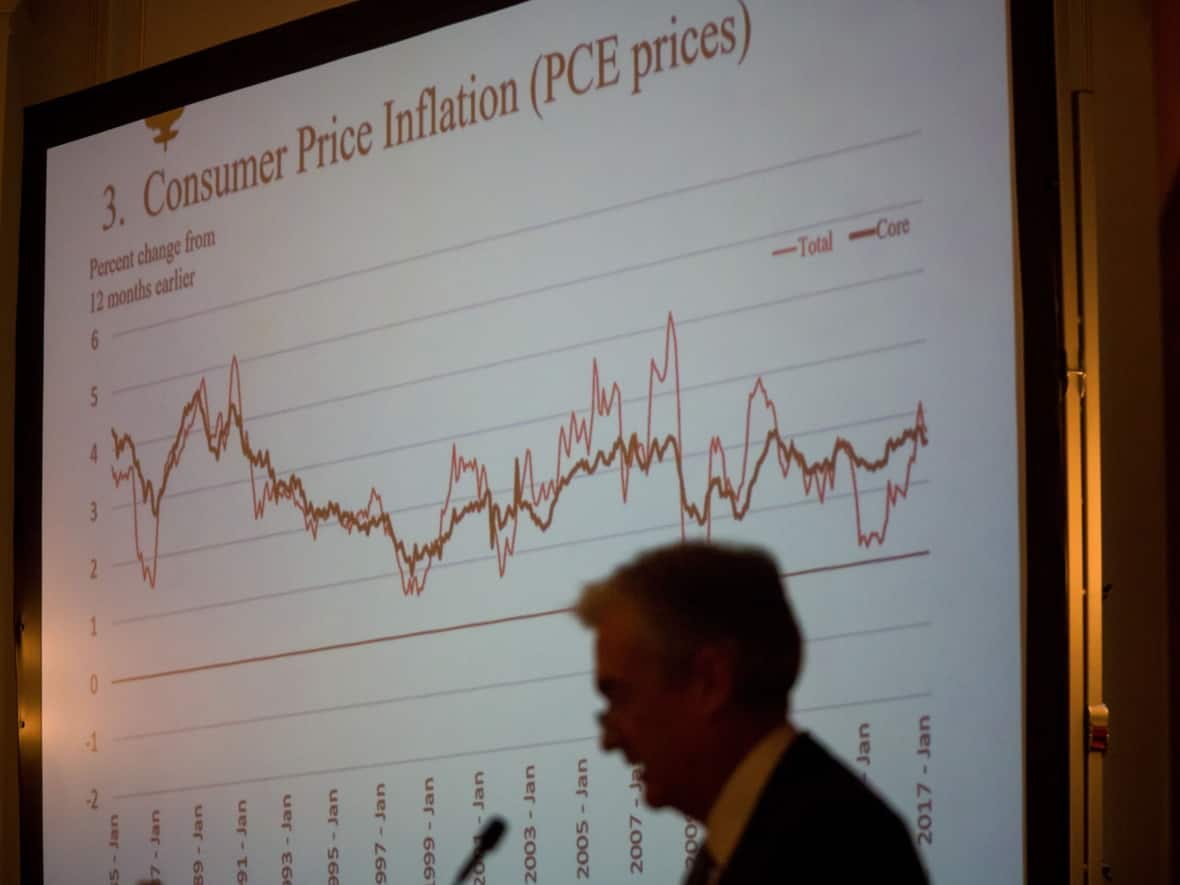

The U.S. inflation rate is currently 8.5 per cent, it's highest level since 1981. Canada's inflation rate is currently 6.7 per cent, its highest level in 31 years.

The Fed's move brings its rate to its highest point since the pandemic began, and although the move was widely expected, there was some thought that the central bank could move even more aggressively.

In addition to the rate hike, the Fed also said it will sell off the trillions of dollars of bonds on its books, a move that will also have the effect of making lending more expensive.

Several more rate hikes for the rest of the year are still expected, until the inflation rate gets back to a range that central bankers are comfortable with, below three per cent.