Caribou Mine near Bathurst goes up for sale

Trevali Mining Corp. is seeking a buyer for its Caribou Mine in northeastern New Brunswick after halting mining last month, filing for creditor protection and laying off most employees at the mine.

On Friday, the Supreme Court of British Columbia approved a sales and investment solicitation process for two of the company's three mines: Caribou near Bathurst and Rosh Pinah in Namibia in southwest Africa.

The court-supervised process involves seeking potential buyers for the two mines or investment in the company to restructure it. The court order sets out a timeline for the process, saying a final agreement should be reached by Nov. 14. The sale would need to be approved by the court.

Vancouver-based Trevali filed for creditor protection in August. Mining was halted at Caribou, which then went into care and maintenance mode. The underground mine, about 50 kilometres southwest of Bathurst, produced zinc, lead and silver.

Executives resign

The company did not respond to an interview request Monday.

Trevali announced on Friday the resignation of the company's CEO and president Ricus Grimbeek, chief operating officer Derek du Preez, and a board member.

"With the SISP Order obtained and the sales process underway for the company's interests in the Rosh Pinah and Caribou mines, the board and Mr. Grimbeek determined that it was the appropriate time for him to step away from Trevali," the company said in a news release.

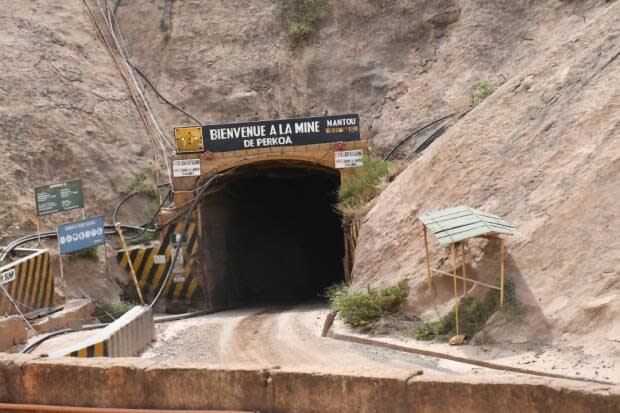

Last week, two people were convicted of involuntary manslaughter in Burkina Faso related to flooding at its Perkoa Mine in April that left eight employees dead.

Mine manager Hein Frey received a 24-month suspended sentence. Daryl Christensen, a manager with Trevali's contractor Byrnecut, received a 12-month suspended sentence.

That flood appears to have played a pivotal role in the suspension of mining at Caribou, according to documents filed in court as part of the creditor protection process.

Brendan Creaney, the company's chief financial officer, says in an Aug. 19 affidavit that Caribou was losing money and the company transferred funds to its New Brunswick subsidiary that operates the Caribou Mine.

His affidavit says the two African mines, Perkoa and Rosh Pinah, have a long operating history and have been profitable.

Mining zinc and lead at Perkoa, Rosh Pinah and Caribou was the company's source of revenue.

The material mined is sold exclusively to Glencore International AG, Trevali's largest single shareholder, or affiliated companies.

The agreement with Switzerland-based Glencore sees Caribou's zinc concentrate sold at a fixed cost of $1.25 per pound.

Producing one pound at Caribou had cost $1.01 in the second quarter of 2021, the court document states.

That rose to $2.20 in the second quarter of this year, meaning the mine was no longer profitable and dependent on funds from Trevali's other operations.

Then came the flood in April that shut down its Perkoa Mine. The document says the company had to spend more than $25 million on the Perkoa Mine since the flood, which has not resumed production.

"The financial and operating stress that the flood at the Perkoa Mine has placed on Trevali has also indirectly limited the company's ability to address recent operational and financial challenges facing the Caribou Mine, which has historically depended on intercompany funding from Trevali Corp. to sustain its operations," the affidavit states.

The affidavit says Trevali's New Brunswick subsidiary "has no means of meeting its liabilities," including about $15 million owed to contractor Redpath Canada Ltd. and other service providers.

"In addition to challenges caused by global inflationary impacts facing the mining industry, the production performance at the Caribou Mine has been significantly and negatively impacted following continued operational issues due to low equipment availability and productivity rates with the mining contractor, among other factors, resulting in lower production results and higher costs," the affidavit states.

The document says Redpath issued a notice of default on Aug. 8, seeking about $3.5 million by Aug. 17.

The affidavit said the company also had indications from other suppliers of things like explosives that were reluctant to continue providing supplies without payment on their accounts.

The company released second quarter financial results Aug. 15 showing a 44 per cent decline in revenue compared to the previous quarter. It said it would likely not be able to pay a $7.5 million debt to one of its lenders that week.

It then filed for creditor protection, which a judge granted Aug. 19.

As of mid-August, Trevali had 121 employees at Trevali and employed 165 contractors. Court filings say 100 of the company's employees have been laid off so far.

A court filing indicates the company has identified various employees across its operations that will receive bonuses to try to keep them with the firm through the sale and restructuring process.

Trading of the company's shares on the Toronto Stock Exchange was suspended Aug. 22 after it filed for creditor protection. The company will be delisted from the TSX on Oct. 3. The suspension of trading continues until it is delisted.