N.B.'s Point Lepreau nuclear plant ranked as poor performer among international peers

Since 2014 the Point Lepreau nuclear generating station has been one of the poorest-performing reactors among dozens of similar facilities in five countries, a pair of unflinching reports commissioned by N.B. Power about the troubled plant suggest.

The U.S.-based energy consulting firm ScottMadden found N.B. Power spent less on upkeep at Lepreau since it completed a major refurbishment in 2012 than owners of more reliable reactors, and they provided evidence that Lepreau's troubles may be connected to a failure to invest enough on maintenance.

The reports also suggest Lepreau's performance may worsen in future years if amounts spent on keeping ahead of trouble are not increased significantly.

"Although the refurbishment initially improved Point Lepreau's performance as expected, in recent years, Point Lepreau has missed its reliability-related projections for outage durations, capacity factors, forced loss rates, and other measures," wrote the company in one of two separate reports.

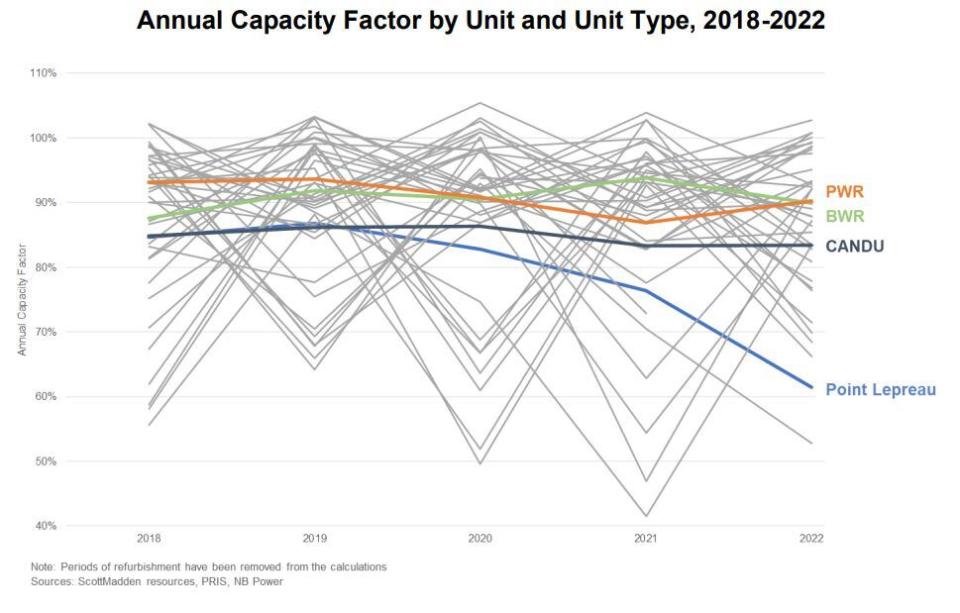

"ScottMadden found that Point Lepreau largely has performed in the bottom quartile among single-unit sites and in the bottom half among individual CANDU units from 2014-2021, and their capital spending has largely been in the bottom quartile among single-unit sites."

The reports on Lepreau, which were delivered to N.B. Power in December, have been submitted to the New Brunswick Energy and Utilities Board as evidence in N.B. Power's upcoming rate hearing.

The 50-year-old Monticello nuclear plant in Minnesota was listed as the most reliable of 19 American single-reactor nuclear sites that were compared to Point Lepreau in a recent evaluation. It operated at an average capacity factor of 96 per cent over a five-year period ending in 2022, while Lepreau operated at an average of 79 per cent, better than just two of the American reactors. (AP)

In one report, ScottMadden was asked to evaluate N.B. Power's plans to increase and then decrease capital spending at the nuclear plant over the next decade. In the second, it was asked to assess N.B. Power's current projections of Lepreau's likely future performance.

Both painted unflattering pictures of the nuclear plant's recent past and potential future.

Lepreau, originally commissioned in 1983, had a disappointing production record in its first 25 operational years that has continued over the last decade, despite a major overhaul of its reactor and nuclear components between 2008 and 2012.

In the 11 years from 2013 and 2023, Lepreau suffered 400 more days of downtime than originally projected, costing the utility up to $1 billion in lost production and repair costs that have been battering the utility's finances.

Some of that excess downtime was caused by scheduled maintenance outages that took longer than planned, and about half were "forced loss" days caused by sudden and unexpected breakdowns at the plant.

In its review, ScottMadden looked at Lepreau's operational performance over eight years ending in 2021 and compared it to 42 "peer" facilities.

Those included 23 other functioning CANDU reactors in Canada, Argentina, Romania and South Korea, and 19 non-CANDU "single unit" reactor sites in the United States.

Planned and unplanned downtime at Lepreau was consistently worse than the group average over the eight years, with ScottMadden drawing particular comparisons to a pair of Romanian CANDU reactors at Cernavoda that it said were an "identical" design to Lepreau.

Energy consulting company ScottMadden has operations in three U.S. cities, including this office in Atlanta. The company says there is likely a connection between levels of annual capital spending at nuclear plants and annual performance. (Cornerstone Contracting)

In 24 combined operational years among the two Romanian reactors and Lepreau between 2014 and 2021, ScottMadden said six of the seven least-productive years belonged to Lepreau, including the four worst years

"Point Lepreau performed poorly relative to Cernavoda," noted the report.

ScottMadden said compared to other nuclear sites with a single reactor, N.B. Power consistently spent less on annual capital improvements than those with a better performance record.

It said utilities that spend between $100 and $120 million per year on capital improvements on their single-unit nuclear plants showed the "highest marginal returns" in performance improvement.

By contrast, it found annual capital spending of less than $80 million is "slightly more likely than not to result in performance declines." In N.B. Power's case, it said annual capital spending over the eight-year period averaged below $50 million.

"Point Lepreau's annual capital spend fell in the bottom quartile for five of the eight years and in the bottom half for all eight years," said the report, citing that as a potential source of Lepreau's weak performance

N.B. Power has disclosed an intention to increase capital spending at Lepreau above $80 million but only for next year. After that, it has a plan to reduce capital spending in stages until it falls below $40 million per year in 2032 and beyond.

This chart shows recent production troubles at Point Lepreau compared to other Canadian-based CANDU reactors and American PWR (pressurized water) and BWR (boiling water) reactors. (ScottMadden)

ScottMadden said it is not aware of another reactor planning to spend less on upkeep in those years and suggested that may come with consequences.

"It is likely that performance could drop even further in the late 2030's into the 2040's," it said.

N.B. Power projects, and ScottMadden concurs, that performance at Lepreau in terms of operational days and "forced loss" breakdown days are unlikely to escape the "bottom" quarter that peer reactors have recently been posting until at least 2031.

In response to pre-hearing questions posed about why it feels Lepreau cannot perform better in relation to other reactors, the utility said it is pushing for modest improvements between now and 2031 and will revaluate targets and budgets for Lepreau as it goes.

"The forecasted plans show a realistic projection for improved performance over those years," said N.B. Power in one response.

"As actual year after year progress is realized, adjustments may be necessary to those targets."