Why Alberta sees so little venture capital but may have 'a winning hand' for future investment

Alberta has been falling short on locking down venture capital but experts and entrepreneurs say a pivot to the tech sector and the reinstatement of a provincial investor tax credit could make a difference.

According to a recent report from the The Canadian Venture Capital and Private Equity Association (CVCA), venture capital investment across Canada is at an all-time high, but Alberta only captures one per cent of the total dollars being invested.

In contrast, Quebec gathered 24 per cent, Ontario 15 per cent and B.C. 12 per cent.

The report found there was $2.2 billion in venture capital — the critical initial funding entrepreneurs need when starting a business — invested across the nation in the first half of 2019. But only $25 million of that total was invested in Alberta.

Darrell Pinto with the CVCA says the dip in energy prices is related to the lack of investment in the province.

"It's no surprise that oil and gas prices globally have been fairly low over the last few years and that has a big impact on innovation investment coming into the province, because it's largely focused on the energy sector," he said.

A primed ecosystem

Albertans have weathered the "highs and lows" of the oil and gas economy, said Kim Furlong, CEO of the CVCA, and this proves they are not "risk averse."

In fact, she believes the province's investment "ecosystem" is primed for growth.

"You've got entrepreneurial people who are not afraid of risk and it's just a question of building the ecosystem and making sure that the private capital that's flowing," she said.

Right now, she said there are about 1,200 startups in Alberta — many in the information and communications technology sector — but they would need a vote of confidence from investors who may be more familiar with traditional Albertan sectors like oil and gas.

"If you would want to have these investors move into clean tech or life sciences, then definitely those sectors require a certain amount of knowledge for investors to feel like they have a good grasp on the technology," she said.

"Investors like stability, they like to know what they're going into and that the trajectory will be smooth."

Big push

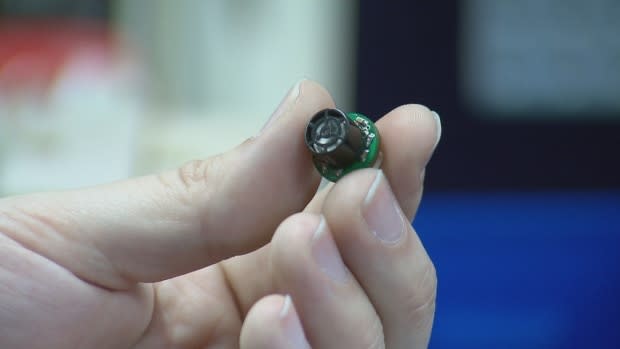

Matt Lowe co-founded ZeroKey Spatial Intelligence, a Calgary startup that develops technology that tracks objects in 3D space and is used for everything from virtual reality video games to automotive assembly lines.

Lowe is well acquainted with the struggle of securing funding from investors.

"It's always a challenge," he said. "Obviously Calgary is not world renowned for its tech industry right now, although it's changing in Alberta."

Lowe said there is a "big push in Calgary" for "tech companies to attract the investors and the investors to attract tech companies and tech founders," but it will take more time and proper infrastructure to be in place for real change to happen.

Winds of change

The potential reinstatement of a currently frozen tax credit that provides incentives for investors to back Albertan companies, the upcoming federal election and investors' general willingness to leap into new sectors could all shake up Alberta's venture capital numbers in the near future, Pinto and Furlong said.

And Furlong is optimistic about the capital forecast for the province's future.

"In my opinion, Alberta has a winning hand," she said.

"It just has to work and play it."