Italy Counting On Up to €3 Billion From Meloni’s Bank-Tax Push

(Bloomberg) -- Italy is counting on receiving as much as €3 billion ($3.3 billion) from its controversial tax on banks, which Prime Minister Giorgia Meloni is determined to push through parliament after the summer break.

Most Read from Bloomberg

China Evergrande Group Files Chapter 15 Bankruptcy in New York

‘Poor Man’s Cocaine’ Costing $3 a Pill Threatens to Proliferate

Goldman Plans Hiring Spree to Fix Lapses After Increased Fed Scrutiny

China’s Hidden Financial Dangers Erupt With Shadow Bank Crisis

Niger Soldiers Killed in Attacks by Armed Group, Ecowas Says

While the government hasn’t publicly said how much it expects to raise from the 40% levy on lenders’ extra profits, officials reckon it will bring in between €2 billion and €3 billion, according to people familiar with their thinking who asked not to be named discussing private deliberations.

The plan, which Meloni has claimed as her own, could still face minor changes during approval by lawmakers, the people said. Antonio Tajani, who heads Forza Italia — part of the three-party ruling coalition — wants it watered down and has said his group will propose amendments.

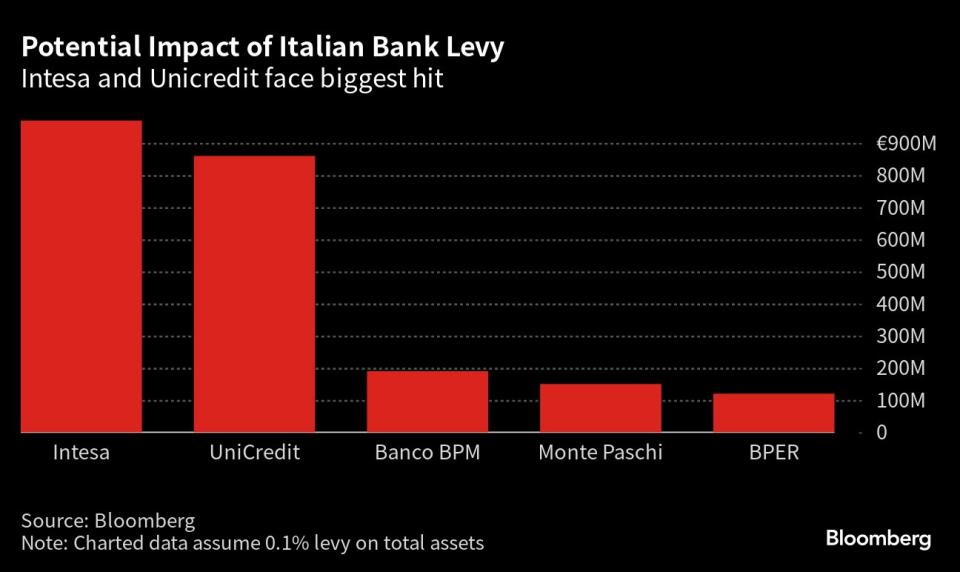

Italy wrong-footed investors when it unveiled the tax on Aug. 7 — erasing an initial $10 billion in market value from domestic banks before they recovered. The government later backtracked partially, saying the measure would be capped at 0.1% of lenders’ assets.

Funds generated by the levy will be allocated to a special fund to help shield families and consumers from the impact of rising interest rates. That could help cushion Italy’s fragile finances if state-revenue targets aren’t met.

The cost for Italy’s five biggest lenders may exceed €2 billion according to Bloomberg News calculations based on their assets. Unicredit SpA and Intesa Sanpaolo SpA face the heftiest bills.

While the government is determined not to further dilute the tax, some minor changes could still be introduced to limit the disruption to banks and placate Forza Italia.

Officials must still clarify details of the assets under consideration — for example, should the cap only apply to Italian assets, its cost would be different. The possibility of making the levy partially tax-deductible is also under discussion, people familiar with the matter said.

Forza Italia’s opposition to the tax isn’t a cause of concern for the stability of Meloni’s coalition, according to several party officials. On the contrary, her tight alliance with League leader Matteo Salvini on the decision to impose the levy may actually boost government unity.

The tax, which is already in force via official decree, must still be converted into law in the fall.

--With assistance from Alberto Brambilla.

Most Read from Bloomberg Businessweek

The Legendary, Wildly Profitable QQQ Fund Makes No Money for Its Owner

‘Don’t You Remember Me?’ The Crypto Hell on the Other Side of a Spam Text

Brookfield Chases Rivals for Private Equity’s New Money-Spinner

Sam’s Club’s War Against Costco Started With $1.38 Hot Dog Combo

Labor Shortage Makes Immigration a Tough Topic for Republicans in Iowa

©2023 Bloomberg L.P.