France’s Next Government to Inherit Resilient Growth

(Bloomberg) -- France’s economy is expected to maintain steady growth this year, easing the budgetary challenges facing the next government after a snap election that delivered a hung parliament and huge uncertainty about future fiscal policies.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

S&P 500 Tops 5,600 Mark in Longest Rally This Year: Markets Wrap

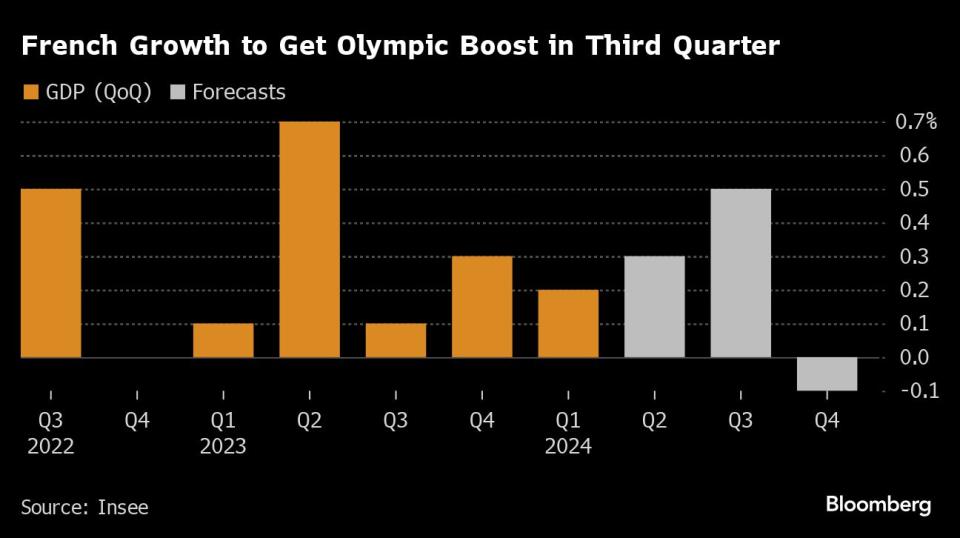

Gross domestic product will expand by 1.1% in 2024, matching last year’s pace, according to forecasts published by Insee, which predicts a boost from the summer Olympics in Paris. Consumer spending growth is set to accelerate, helping offset a contraction in business and household investment.

Still, the statistics agency cautioned on Tuesday that much of its analysis relied largely on indicators from before President Emmanuel Macron dissolved parliament on June 9 and doesn’t take into account the potential impact of different fiscal measures.

The resilience of France’s economy is a crucial asset for any incoming government, which will immediately face negotiations with the European Union over how to narrow the budget deficit. The current administration’s plans are based on 1% growth, a forecast previously seen as optimistic compared with the 0.8% predicted by the International Monetary Fund.

How to manage France’s finances was a central issue in the short, turbulent election campaign in which the left proposed a vast increase in spending and even Macron’s party promised more outlays. The noise over fiscal policy and the possibility of Marine Le Pen’s far-right National Rally winning power rattled investors, who dumped French assets. A survey of voting intentions carried out after polling stations closed on Sunday shows Le Pen would finish in front in the first round of the next presidential election in 2027.

Listen and follow The Big Take on Apple Podcasts, Spotify or wherever you get your podcasts

Spending Pledges

With a hung parliament, it’s not clear how much of the spending pledges will survive. The leftist New Popular Front alliance has the largest group of seats in the lower house and is demanding that its program be implemented, but it would likely have to make huge compromises to form a coalition capable of governing.

“Backtracking on supply-side policies to return to demand-stimulus policies would be an irreversible economic error,” Finance Minister Bruno Le Maire warned in a briefing with reporters. “We must stop any return to the past or any calling into question of this supply-side policy by a relative majority in the National Assembly.”

Insee said that in addition to budget uncertainties, the next political context is likely to change the behavior of households and businesses. Moves in financial markets that have driven up borrowing costs could mean companies take a “wait-and-see” approach to investment, it added. French stocks slumped for a third straight day on Tuesday as investors awaited clues on the next government.

“The evolution of the political situation in France is a significant risk” to the growth scenario, Insee said.

If political wrangling causes France’s fiscal and debt metrics to materially worsen, the sovereign rating of the euro zone’s second-biggest economy could also be at risk, Moody’s Investors Service warned in a separate report.

(Corrects figures for 4Q 2023 and 1Q 2024 in chart after second paragraph)

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.